Synopsis of the week

- Since 2009, the S&P 500 has now seen gains of 418% and the current bull market run has lasted 3,450 days. This is now the longest run although not the biggest move.

- Last week’s speech from Fed Chairman Jerome Powell at Jackson Hole confirmed a continuation in the current pace of US Interest rate rises, regardless of inflation rates meeting targeted 2% levels.

- Damning testimony from Michael Cohen has increased the chances of Donald Trump becoming only the third US President in history to be impeached. With both the House and the Senate having a Republican majority, this is still some way off.

Press coverage

On Wednesday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Richard Jones, FX & Rates Strategist. In this week’s show, they discussed the recent performance of the US Dollar, Pound and Euro along with the most recent expectations of central bank interest rate policies. They also discussed the comparative strengths of investing in Asia, Europe, the US and Emerging Markets.

Click here to listen to the interview on Bloomberg

It is a couple of weeks since I last wrote Fern Wealth weekly notes and in that time, much has happened and yet little has changed. Reviewing the last notes I wrote before enjoying being away with the family, geopolitical problems dominated the headlines while the US reporting season looked to be heading towards another strong set of seasonal figures. Subsequently, US corporate earnings were very strong albeit with a few big notable exceptions and equity markets have continued to move higher. I have stated, all through 2018, that I believe it will be the fundamental data that will drive the direction of equity markets and the press attention given to all the geopolitical problems will only ensure that the trajectory of these moves higher will not be in a straight line.

Last week saw the S&P 500 set a new record for the longest bull market run, 3 450 days without a bear market. In that time, we have seen several corrections where the markets have sold off by more than 10% but the net move since 2009 still sees the S&P 500 up by almost 420%. It is worth noting that although this might be the longest, it is not the highest and we believe equity markets will end the year 2018 higher than they started.

The US Dollar has remained strong throughout the summer months and last week’s comments from US Fed Chairman Jerome Powell are the primary reason why. The path of continued interest rate increases from the FED has been clearly stated and the FX markets continue to factor in another two increases before the end of the year. The Swiss Franc has also been strong and the EUR/CHF rate is now at 1.1428 above its recent week lows of 1.1243 but well off its pre-Summer highs of 1.2000 Considering the physiological importance of the 1.2000 level, where the Swiss National Bank previously held its peg against the Euro, we are not too surprised it has met with resistance here. Our longer-term expectations continue to be that we will see EUR/CHF rate back above 1.2000 and heading higher.

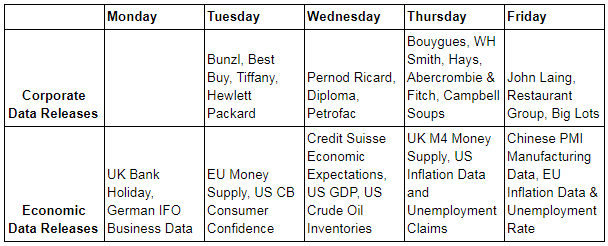

With the UK enjoying a summer bank holiday on Monday, we should see a quieter start to the week, certainly until mid-afternoon when the US equity markets come online. There are not too many sizable corporate or economic data releases due, but with most schools now back we do expect to see trading volumes begin to pick up.