Synopsis of the week

- Monthly Non-Farm payroll figure misses the mark coming in at the lowest levels since June 2016.

- The FOMC struck a considerably more dovish tone bringing into question how many more rate rises we’ll see in 2017.

- The US Market struggled as both FOMC comments and US politicians gave investors cause to reassess the likelihood of spending and tax changes under the Trump administration.

- Steve and I visited one of our Asset Management companies, Moventum, in Luxembourg last week. It was a productive trip which has equipped us with a deep understanding of their managed funds. We’re looking forwards to sharing more about this exciting area with our clients.

Press coverage

Last week I was interviewed by Ed Bowsher on Share Radio where we discussed the market’s reaction to the US military strikes in Syria and weak UK industrial production data. The link to this interview can be found here.

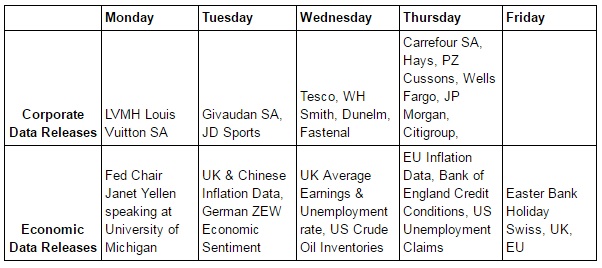

The Week Ahead

Economic Data

Last week Donald Trump launched missile strikes on Syria. The previous couple of days had also seen the Trump administration talking seriously about the possibility of military action in North Korea. This saw oil spike higher as traders factored in a possible disruption to oil supplies. It also saw a controlled flight to security as the Gold price jumped up to intra-day highs of $1271, levels last seen in November 2016.

On Wednesday the markets were able to digest the minutes from the FOMC’s last meeting. Fed Chair, Janet Yellen struck a considerably more Dovish tone. Market traders had less conviction that the FOMC would raise rates twice more before the end of the year. In the same day, Paul Ryan the current Speaker of the US House of Representatives said “The white house hasn’t nailed it down yet” when talking about Trump Tax reforms.

Market watchers were probably quite optimistic with the previous day’s private ADP payroll figures which were particularly strong. Expectations had been for 174,000 new jobs to have been created, but with only an improvement of 98,000 announced, markets weakened.

Following the release of strong UK Service sector data this week we heard from the Bank of England Governor Mark Carney as he talked up the values of the financial sector in London. This is exactly the type of action we will expect to see from central bankers around Europe as they all “talk up their own books” during the next two years of Brexit negotiations.

Luxembourg

Last week Steven and I spent a couple of full days visiting Moventum in Luxembourg to meet with the asset management and senior management teams. We pride ourselves on our proactive involvement with our partners which strengthens our working relationship.

These meetings enabled us to drill down to the very core of what triggered changes in market exposure and sector weighting and with this greater understanding, we can provide a superior advisory service to our clients. More information to follow on this.

Corporate Releases

The last few weeks have seen little in the way of corporate data releases but this week that will all change with the start of the US reporting season for Q1. The US banking sector takes prominence with Wells Fargo, JP Morgan and Citigroup updating the market.

As mentioned already, with stronger oil prices feeding into higher inflation it will be interesting to see how Tesco and Carrefour will perform. As the two biggest food retailers in Europe, we will be able to gain an insight into how higher inflation is affecting shoppers habits.