Synopsis of the week

- Last week saw equity markets drift lower as investors moved into a risk-off mentality.

- Mario Draghi, Head of the European Central Bank has once again spoken in enthusiastic terms about the markets and gone some way to quashing fears that the ECB are ready to change their approach to the current quantitative easing scheme.

- Wednesday’s US ADP jobs figures were a precursor to Friday’s impressive Non-farm payroll figures. Friday’s jump, in jobs being created, was also accompanied by last month’s data being upgraded.

- Fern Wealth’s managerial relations are set to be tested this weekend as the annual England v Scotland Six Nations rugby match will see management & sons crowded around the same screen to cheer on opposing sides. Obviously the Scots coming out on top would be the preferred result.

The Week Ahead

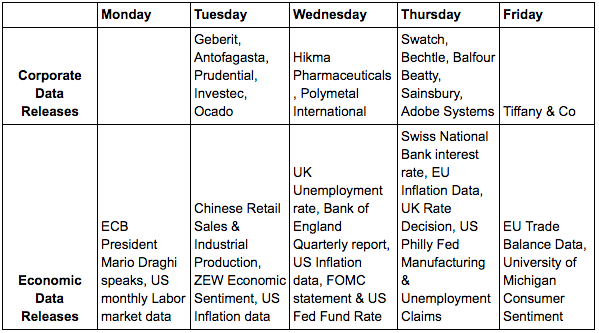

Economic Data

The impressive Non-Farm payroll figures released on Friday have paved the way for the Fed to raise interest rates this Wednesday. Expectations are for Fed Chair Janet Yellen to announce an increase in the US base rate from 0.75% to 1%. If we take a look at the FX markets as a leading indicator, we can see US Dollar has continued to strengthen over the last couple of weeks. GBP/USD at the end of the week is sitting at $1.2165 having been as high as $1.2550 only two Fridays ago. Although this change in interest rates has already been partially factored in we would still expect to see even more of a move should the Fed finally pull the trigger.

This was a week where ECB President Mario Draghi updated the markets on how the central bank was viewing recent changes to its economic landscape. The key aspects being the ECB saw a change in the interest rate cycle and that no further decreases were likely as worries over deflation had reduced. This change in stance saw the markets asking how long before they would see a change to the current levels of monthly QE. Once again it was the FX markets that most reflected this change with EUR/CHF climbing up to €1.0760 levels last seen in the tail end of 2016 and having spent most of the previous six weeks hovering just above €1.0640

We read with interest a Reuters article on Friday the Swiss government is looking at proposals to force non-EU foreigners to sell their properties when they leave the country. We will be watching to see how this develops, click here for the full article.

Corporate Releases

With major corporate releases being scarce this week there are no standout sectors to watch. However, we could see a US Dollar increase in strength (on the back of the FED decision) benefiting those equities that derive a sizeable income in US Dollars. Think commodity sector – so watch this space.

On a stock-specific issue, rumours have circulated the city of London that ExxonMobil are looking at making a bid for FTSE quoted BP. A price of 600p has been widely referenced and helped trigger a jump of over 4% during Friday trading (closing at 470p). Experience has taught us there can easily be a sizeable disparity between rumour and fact. We will closely be monitoring how this story unfolds especially as Fern Wealth clients are already long of the company from lower levels and have already received a 9p dividend.