Synopsis of the week

- The UK finally triggered article 50 on Wednesday in an event that barely caused any reaction in the equity markets around Europe.

- Euro zone inflation fell, weighed down by a big drop in German data. This could reduce the pressure on the ECB to bring the current QE scheme to an end.

- US Consumer confidence figures jump hitting levels not seen since December 2000.

- Equity markets close out an encouraging first quarter of 2017.

The Week Ahead

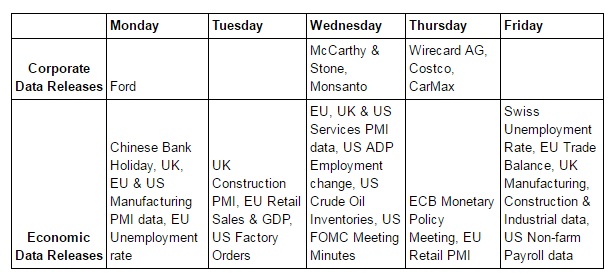

Economic Data

The benefits of the “Trump trade” have faded over the last couple of weeks following the administration’s failed efforts to push through their health care policies. Even so, equity markets have rounded off a good start to the year. The FTSE 100 was up by 3.2% while the S&P500 and the Dow were up 5.6% & 4.72% respectively. The standout performer of the major equity markets, however, is the German Dax which so far in 2017 has jumped by 7.53%

We still feel equity markets will continue to tick higher throughout the rest of the year as a combination of US Tax reforms and infrastructure projects are announced by the Trump administration. Next week will once again see US Non-farm payroll data being released. Judging by the strength of last week’s US consumer confidence data (the highest it has been since December 2000) we should see a continuation of strong jobs growth.

The triggering of Article 50 on Wednesday by the UK’s Prime Minister, Theresa May did not instigate any major moves in equity markets in the UK or across Europe. We anticipate this will see an increase in politicians on both sides of the channel voicing increasingly aggressive demands. Most of this will be background noise to what will ultimately unfold which could well trigger volatility in various sectors as politicians pick and choose different business sectors for their very public debate.

Last week saw inflation figures from around Europe drop with one of the largest fallers being Germany dragging down the combined EU Inflation figure. The lacklustre performance of Oil prices will have been one of the largest contributing factors to this. As inflation levels have fallen away, the pressure on the European central bank to bring to an end its quantitative easing scheme has diminished and this should be positive for European equity markets.

Corporate Releases

This week will offer very little in terms of corporate data to digest with Ford being the highlight from a very short list.