Synopsis of the week

- For the ninth month in a row the Fed have decided to leave US rates unchanged. Ahead of Wednesday’s decision, markets had only been factoring in a 20% chance of change and subsequently Equity and FX reactions were muted.

- Three of the nine voting members voted for change adding to the likelihood of a move in December especially as November’s meeting is only days before the US election.

- Commodities looked to have found a new lease of life. The FTSE mining sector had its best weekly move since the end of June and hit a weekly high not seen since June 2015.

- OPEC and oil producing countries at large continue to be their own worst enemy. The willingness of markets to absorb pre-OPEC meeting speculation over production cuts, highlights how little confidence investors have that they will reduce production in any meaningful way.

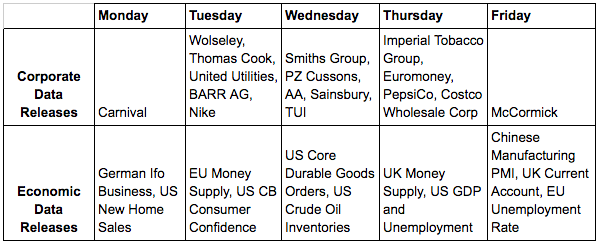

The Week Ahead

Economic Data

Once again the Fed have voted against raising rates although the voting has now changed from 8-1 to 6-3 so we are getting closer. On closer inspection of Fed Chair Janet Yellen’s comments, it’s worth noting that the enthusiasm of traders has been dented by the aggressive sell off triggered in last Friday’s US trading session.

One of the biggest beneficiaries of this inability of the Fed to pull the trigger, has been the mining sector. Both commodities and companies involved in this arena are having good weeks. This week should see that momentum maintained until at least Thursday evening. Chinese manufacturing PMI data is out overnight Friday which will hint as to how much long term confidence is warranted.

Although not an economic data release the Monday night debate between Hillary Clinton and Donald Trump will be watched by traders in an effort to gauge who holds the upper hand going into the final weeks of the US elections. It’s becoming increasingly obvious that the possibility of a Trump success in this race has been underestimated by the city and momentum is very much with him in the run up to the election on the 8th November. With their wildly opposing views on the importance of international trade it’s not just the US that will be watching with interest.

Corporate releases

Barr AG who manufacturer Scotland’s second favourite drink behind Whiskey Irn-Bru, will be posting results on Tuesday.

The travel industry will come under scrutiny this week as results from both Thomas Cook and TUI travel will be released. Like the airline sectors they will have found holidaymakers considerably less adventurous due to the increasing threat of terrorism.

Wednesday will see Sainsbury post its second quarter figures. But with Kantors having already released the food retailers market share data last week, the cat is rather out the bag.

Image by Kai Pilger from Pixabay