Synopsis of the week

- The Bank of England have decided not to add to the stimulus measure that they took in September. While at the same time they have reaffirmed their intentions to take further actions in the future if required.

- European equity markets spend the week drifting lower as weak economic data and a lack of stimulus can’t prevent the bears from gaining the upper hand.

- The US department of justice have asked Deutsche Bank to pay $14 Billion relating to mortgage backed securities. This announcement saw another 7% wiped off the share price which now sits over 90% lower than its pre financial crisis level in the summer of 2007.

- Friday’s EU summit held in Bratislava was without a British representative. Negotiations were never going to be easy and even with article 50 not yet being triggered numerous EU member state representatives have taken a hard line on what flexibility they will be willing to show Theresa May and her team.

The Week Ahead

Economic Data

The enthusiasm of traders has been dented by the aggressive sell off triggered in last Friday’s US trading session. Over the week the majority of the european equity markets drifted lower and have shown little real sign of gaining upward momentum. Too many of the important economic releases over the week have missed their mark including UK inflation, German ZEW economic sentiment and US retail sales. Throw into the mix the fact that the Bank of England voting members unilaterally voted against adding further stimulus, it left little to raise the spirits of traders.

One ray of light that did catch my eye was the increased demand in China for copper which gave a boost to the mining sector.

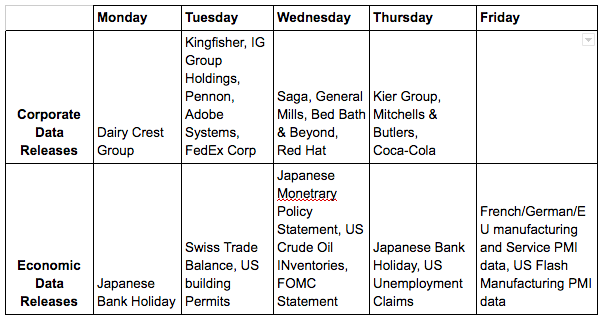

A Japanese bank holiday on Monday should ensure a quiet start to the european trading week. There has been a plethora of comments coming from EU leaders regarding the departure of the UK from their club which has added to the confusion about future consequences.

Tuesday will see the results of the overnight Australian monetary policy meeting. This comes before the Swiss trade balance figures and US building figures are released.

The morning session on Wednesday could have plenty of Asian influence with overnight Japanese Trade balance figures, Monetary policy statement and a Bank of Japan press conference to absorb. The focus will then shift to Europe where the Bank of England and the Swiss National Bank will be posting quarterly bulletins. The afternoon will see no let up in the economic data being released as Crude Oil inventories are first up. In the evening the US FOMC will release its economic projections and funds rate before holding a press conference. Expectations of a rate change are very low but the phraseology used will be intensely scrutinised for any sense of timing for changes in the future.

Thursday will be a quieter day with a Japanese Bank Holiday, but ECB president Mario Draghi is due to speak at an event in Frankfurt. On Friday trader’s attention will be held by the multitude of manufacturing PMI data releases around europe and the US.

Corporate releases

Not too much to get excited about when looking at corporate releases this week although DIY company Kingfisher will be posting half yearly figures on Tuesday. Considering the UK weather and events like the Olympics keeping people busy, this could be a difficult six months. IG Group will be announcing first quarter figures and because of disappointing CMC figures less than a month ago, market expectations will be low.

From the US markets we will be hearing from FedEx, Adobe and Coca-Cola, a diverse array of companies none of which on their own are too likely to take the focus away from the economic data releases of the week.