Synopsis of the week

- The initial panic seen in Asian trading as a Republican victory became increasingly likely was swiftly replaced by optimism as traders looked forward to the US spending their way out of trouble.

- Biotechnology, pharmaceuticals, energy and construction sectors lead the way in the aftermath of last weeks political developments.

- Companies with businesses inside the US rallied but increased uncertainty over the future of global trade agreements saw US Dollar weakness the FX markets punish those currencies most likely to suffer in any new shakeups.

- We will be closely watching to see how long the honeymoon period lasts. The catalyst for bringing this to an end is most likely to be President Elect Donald Trump himself.

The Week Ahead

Economic Data

Last weeks economic releases were broadly ignored as global markets held their breath in anticipation of Wednesday’s US election results then scrambled to re-balance their exposure to the new political landscape in the US.

Prior to last week, markets had been giving an 85% chance that the FED would raise US rates in December, that level has now been smashed back down to less than a 50% chance. Fed Chair Janet Yellen (someone who has received less than complimentary statements from Donald Trump in the past) will be only too aware that this fresh uncertainty hanging over the US economy will take some time to become clear in economic releases thus extending the committee’s inaction on rate decisions. Any early drafts that the Fed chair had prepared for her speech on Thursday to the joint Economic chiefs have probably been binned and a complete reworking been embarked upon.

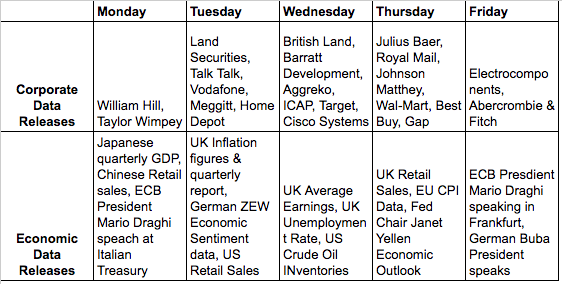

Although demanding the majority of our attention, it is not all about the US, and next week European traders will have a number of leading barometers to monitor themselves against. ECB President Mario Draghi will has important speeches on Monday at the Italian Treasury and then on Friday in Frankfurt. In between these events we will also be hearing the UK’s quarterly inflation report no doubt given even more of a boost from recent FX market moves.

The latest German ZEW economic data releases will also be watched to gauge business optimism in the EU.

Corporate releases

Much like the economic data of the week, corporate news flow could well play second fiddle to moves in sectors most likely to be affected by the new US economic landscape.

UK builders dominate the european corporate releases this week with Taylor Wimpey, British Land Barrett Development and Land securities all posting quarterly figures or trading updates. This sector along with financials is the most susceptible to moves following the UK’s Brexit vote earlier in the year. A few other equities might well be worth monitoring such as Royal Mail with a generous 4.19% dividend yield and Aggreko, although normally benefiting from cyclical global sporting events may well be one of the beneficiaries from increased business in the US.

The tail end of the US reporting season will see Cisco Systems, Gap, Wal Mart and Abercrombie & Fitch all updating traders.

Where now

Fern Wealth’s clients will have been aware that prior to the US general election we took a risk-off mindset and increased our cash holdings and reduced equity exposure. The aftermath of Wednesday’s results saw a huge amount of volatility within the following 24 hours. Markets do not like uncertainty and now that we know Donald Trump will be the next US President a line has been drawn in the sand. We are conscious that this new President has considerably less political experience than all of his predecessors and that he will hit the odd bump in the road but a clear sense of direction is already materialising. We anticipate the US will have both increased debt and increased spending over the next four years. We expect that the initial moves in the Pharmaceutical, Biotechnology, Construction and Energy sectors will be added to as US$600 billion has already been earmarked as the initial spend to help “Make America great again”.