Synopsis of the week

- Crude Oil prices continue to hover around the $56 and with OPEC member’s commitments continuing to be met, might this be the time for a more meaningful move higher?

- This week has seen the MSCI’s World Index rally to a fresh all-time high showing that equity traders have not lost faith that markets will go higher.

- The Dow Jones has hardly looked back since Donald Trump has come to power. The index is now closer to 21,000 than 20,000 and has increased by 4.5% since the 20th January.

The Week Ahead

Economic Data

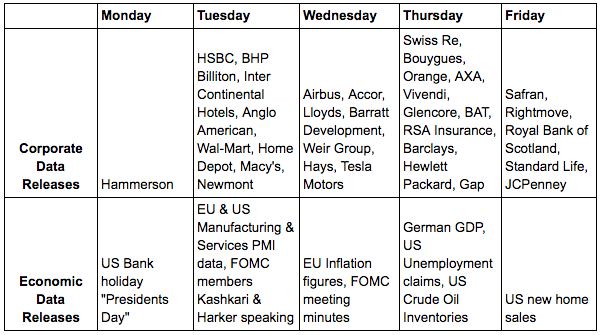

The US will enjoy a long bank holiday weekend as they celebrate “Presidents Day” on Monday. Of course, how many people feel that a whole day spent celebrating a President is a good thing is more open to debate.

Tuesday will see both manufacturing and service purchasing managers index figures being posted for France, Germany, European Union and the US. Manufacturing data out of all of these regions has been improving over the last six months and it will be interesting to see how much further growth can continue to climb.

The markets will also be listening to speeches from both Neel Kashkari and Patrick Harker, voting members of the FOMC to glean information as to when the next US interest rate rise might be.

Credit Suisse will be making their calls on Swiss economic expectations on Wednesday morning followed by European inflation later in the morning. Wednesday evening will see the minutes of the last FOMC meeting being published once again offering the FX market an opportunity to analyse when US rates will increase.

Heading towards the weekend, Thursday and Friday data releases will offer little in the way of market triggers with US Crude Oil inventories and US unemployment claims being the exceptions.

Corporate Releases

Next week will see the markets focusing on UK banks as HSBC, Lloyds, Barclays and the Royal Bank of Scotland will all be reporting throughout the week. Keeping with the financial theme we will also hear from Swiss Re, RSA Insurance and Standard Life. The UK is further behind the US in the recovery cycle for interest rates rising but with inflation increasing it is offering a more appealing outlook for UK banks.

As sterling struggles to find further strength against the US Dollar, mining giants like BHP Billiton, Newmont mining and Glencore should all be able to impress the markets when they post their latest updates.