Synopsis of the week

- EURCHF breaks above the 1.10 level a climb of over 2% in the last three weeks but still some way short of UBS’s 1.14 price target for years end and 1.16 in the next twelve months.

- US inflation data falls and retail sales shrink sending the US Dollar tumbling during Friday’s trading session.

- Brexit negotiations are set to return on Monday and EU chief negotiator Michael Barnier is still unsure of what the UK government’s stance is.

- During the semiannual Monetary Policy Report Fed Chair, Janet Yellen, casts doubt on the Trump administration’s target of 3% GDP growth.

Press Coverage

Fern Wealth’s Director of Investment Management, Alastair McCaig, joined Bloomberg’s FX and Rates Strategist, Richard Jones and host Caroline Hyde to discuss UK real earnings, unemployment & Brexit. They also looked at cryptocurrencies and how Revolut has just raised $66 million for its global banking arm.

Click here to listen to the interview on Bloomberg

FX Markets outlook

We at Fern Wealth have for some considerable time have been trying to highlight the changing perception of where fair value in the Swiss Franc is. We have clearly stated that we believe the current level in EURCHF will head higher in the longer term. The following Bloomberg article succinctly encapsulates much of our thinking and is essential reading for all expats living in Switzerland.

The Week Ahead

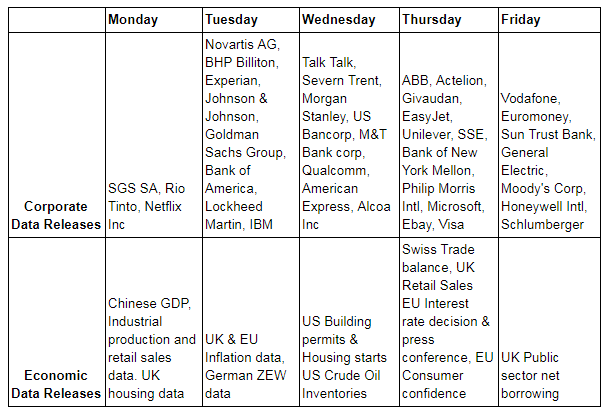

Economic Data

The Swiss Franc has fallen away over the course of the week against both the British Pound and the Euro. In previous weekly notes, we have stated some of the reasons why we believe the Swiss Franc will weaken in the longer term, such as diminishing need for a flight to security and an improving outlook for the Eurozone. Certainly, the short term performance of the Franc suggests this is a perception that is becoming increasingly more common. It is worth noting that this has not been triggered by any one piece of economic data but more a shift in FX markets. Thursday will see the latest interest rate decision from the European Central Bank. No change is expected but the ECB President Mario Draghi’s press conference afterwards will be closely scrutinised for any hint of a shift in consensus.

The confidence the markets had that the US Fed would trigger another interest rate rise this year is being strongly tested in the wake of comments made by Fed Chair, Janet Yellen, over the last couple of weeks. Two weeks ago she stated that US equities were somewhat overvalued if judged by historical earnings metrics. This week she has voiced her doubts that the Trump administration will be able to oversee an economy that will show 3% GDP growth. Independently neither of these two comments are outrageous but coming from her this does feel like her confidence is being tested too. Part of the reason for this is the increasing questions about the US reducing stimulus, whilst at the same time raising rates. Is the US economy able to handle both of these happening at the same time? Certainly, not everyone is convinced.

This economic uncertainty has however not dented the enthusiasm for equity markets, with both Wall Street and the S&P 500 ending the week at record closing highs.

On the other side of the Atlantic, the UK continues to look indecisive when trying to formulate its stance on Brexit. It is somewhat embarrassing that the 26 member EU Brexit negotiation team has a more unified stance than the UK. The clock is already ticking and with 20 months left before the article 52 deadline, it is far from clear how these negotiations will develop. Even with all of these unknowns surrounding the UK’s economy, GBPUSD has jumped by 1%, smashing through the previous resistance at $1.30 and taking it back to levels last seen in October 2016. This move has more to do with the US Dollar weakening rather than Sterling strength.

The Bank of England is currently juggling historically low unemployment levels with rising inflation rates. Tuesday’s update is expected to see consumer price inflation increased to 2.9% but with average hourly earnings remaining very weak it is difficult to see how the BOE can start raising the base rate just yet. This is a conundrum that the US FOMC is also having to tackle.

Corporate Releases

The first tranche of US banks to report, Wells Fargo, JP Morgan and Citigroup all closed Friday’s trading down 0.7% or more. The markets had hoped that US financials, having last week cleared the latest banking stress test, would be in a position to impress with improved dividend payments and share stock buybacks. This, however, did not transpire to be the case. This week we will hear from Goldman Sachs, Bank of America, Morgan Stanley, US Bancorp and Bank of New York Mellon. Following on from last week’s disappointment the benchmark for Financial reporting this week is likely to be set much lower.

Other than the Financials, no one sector dominates the rest of the week but some particularly important heavy weight blue chip equities are reporting and could help set the tone for the next couple of weeks. We will be watching out for results from BHP Billiton, Qualcomm, eBay, Visa, Microsoft, Unilever and Vodafone.