It’s always too easy to put off the idea of investing and as markets head lower in light of growing global economic uncertainty, 2022 is certainly proving no exception. However, history shows us that despite the inevitable short-term volatility, over a ten, fifteen or twenty-year time horizon, investing in the financial markets will invariably offer a more profitable outcome, rather than leaving surplus cash on deposit with a bank. And in a high inflation environment, it has never been more important to ensure your money is working hard.

There are however four golden rules that need to be adhered to here:

1. Little and often

By investing in small, regular chunks, you even out the average price at which you invest. Those who invest a single lump sum are left especially vulnerable to any short-term sell-off in the market. Regular investing isn’t about trying to time the market, but instead leaves investors looking to avoid the peaks and troughs. With that in mind, making those regular investments on a disciplined basis removes the risk of buyers’ remorse.

2. Understand this is a long-term commitment

History shows us that whilst equity markets can be volatile in the short term, once you start looking beyond a ten- or fifteen-year time horizon, outperformance over holding cash is the normal outcome.

3. Spread the risk

Ensure your investments are suitably diversified. Again, this is all about smoothing the curve as you seek to generate sustainable returns over the long term – this isn’t a get-rich-quick strategy, so you’re not trying to pick a single stock or even an asset class that might see huge returns.

4. Increase investment contributions regularly

Over time, we all understand that prices will rise and hopefully this will be supported by rising income. A disciplined approach should account for increasing investment contributions on a regular basis, too.

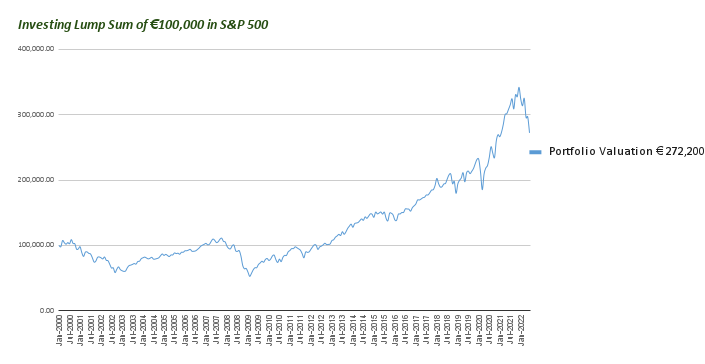

The first chart shows the effect of having invested EUR100,000 in an S&P 500 tracker on January 1st, 2000. This was admittedly just before the “dot com” bubble burst, resulting in marked declines in the early stages but this also clearly illustrates the risk that lump sum investing brings with it. By 2006 those losses had been recovered, but the portfolio then moved back below the initial value again from 2007 to 2012.

In only 144 out of the 270 months observed was the portfolio worth more than the original investment, although supporting the benefits of investing for the long term, by summer 2022, the holding would have been worth EUR272,000. That represents a total return of 172%, representing a compound annual growth rate (CAGR) of a respectable 4.6%.

However, can different strategies be adopted to try and improve the returns potential further?

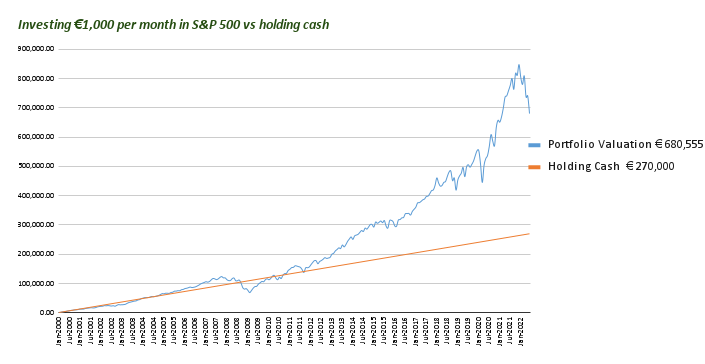

The second chart below illustrates what would have happened to an investor paying EUR1000 per month into the same vehicle, in turn highlighting the benefits of cost averaging. This represents a bigger risk in the early stages of the investment cycle and in the example, we are using, markets fell sharply over the first few years. However, despite this, of the 270 months observed, in 202 of these instances investing in the S&P 500 gave a more profitable outcome than remaining in cash. In the chart below, that’s represented by the blue line being below the orange line. No such occurrences happened in the last ten years of the investment, again underlining the importance of taking a long-term view. By the summer of 2022, that disciplined approach would have resulted in a portfolio valuation of EUR680,000 off a total investment of EUR270,000, which represents an improved CAGR of 7.55%.

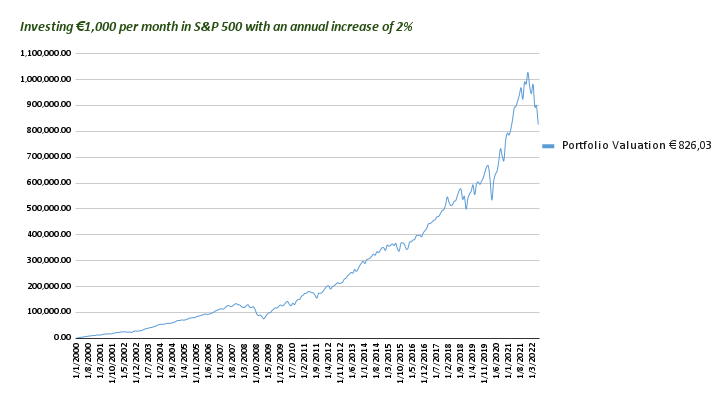

The current inflationary pressures we are all experiencing are widely reported and require consideration from an investment perspective with cash savings in the bank being eroded over time. Investing this cash is one way of keeping up with inflation and critically, if investors can be motivated sufficiently to increase their contributions on a regular basis, the outcome is even more dramatic.

In this example, the investor contributes EUR1,000 in the first month and then increases this by 2% every year thereafter (representing normalised inflation). Whilst this means that the total contributions would have amounted to EUR341,202, the final portfolio valuation by June 2022 would have been worth EUR826,033 or a further enhanced CAGR of 7.71%. This outcome would have been significantly more flattering had the market not fallen so sharply in the early part of the year, but again illustrates the importance of holding for the long term.

Fern Wealth offers investors a wide range of discretionary managed services, enabling a team of qualified professionals to look after client portfolios on a full-time basis. Investing shouldn’t be a burden, but by taking a disciplined approach, ensuring portfolios are diversified and being willing to make a long-term commitment, even in the most challenging of climates the stock market has consistently yielded significant returns.

Markets may be precariously placed right now, but properly diversified buy-and-hold investment strategies have historically delivered strong returns, especially once a meaningful time horizon is taken into account. Past performance may not be an accurate indicator of what happens next, but it’s difficult to argue against the themes here.

Should you wish to have a conversation about your finances, please don’t hesitate to get in touch with us for a quick chat or a full financial review.