Synopsis of the week

- The ECB kept interest rates unchanged, which triggered dramatic moves in the Euro following its press conference.

- The recent success in passing “bank stress tests” has already been forgotten about as US banks have seen their shares slide following that latest quarterly update.

- The second round of Brexit negotiations saw a divergence of opinion on how constructive they had been, with the EU chief negotiator Michael Barnier down playing his UK counterpart David Davies enthusiasm.

- Worries over how the US will balance increasing interest rates and reducing stimulus, without destabilising the recovery, has seen the US Dollar index drift to its lowest levels since August 2016.

Press Coverage

On Monday morning Alastair McCaig, Director of Investment Management at Fern Wealth joined Bloomberg Daybreak Europe’s Nejra Cehic and Caroline Hepker discussing US Dollar weakness, bank earnings and the Fed’s plan for tightening monetary policy.

Click here to listen to the interview on Bloomberg

On Wednesday evening Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s FX and Rates Strategist, Richard Jones and host Jonathan Ferro, to discuss the European Central Bank interest rate decision, French President Emmanuel Macron and UK pensions.

Click here to listen to the interview on Bloomberg

On Friday afternoon our Director of Investment Management Alastair McCaig comments on Dukascopy TV. Discussing the ECB interest rate decisions and stimulus policies, Euro strength and Swiss Franc weakness.

Click here to listen to the interview on Dukascopy

The Week Ahead

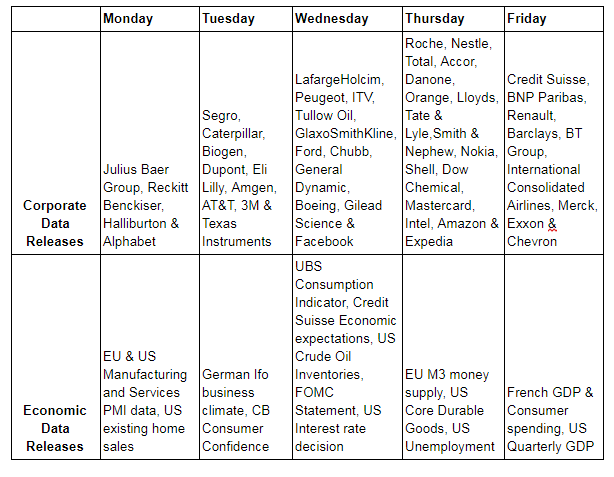

Economic Data

This week has been dominated with big moves in the US Dollar, Euro, Swiss Franc and the Pound. The catalysts for these have been quite varied but in terms of gaining strength, the Euro has been the clear winner. The US FOMC have been seen to be less sure of themselves over the last number of weeks. FED Chair, Janet Yellen, has sounded less convincing as she does not want to negatively affect the current recovery in the US economy, while still needing to increase interest rates and reduce the fiscal stimulus packages. The EU, on the other hand, has tried to downplay how close they are to tapering the current QE scheme, President Mario Draghi’s words of caution appear to have been taken with a pinch of salt by FX traders. The Swiss Franc, an already overvalued currency, has seen its appeal diminish as the EU has recovered, a state of affairs that the Swiss National Bank Chairman, Thomas Jordan, will be only too pleased about. Finally, the British Pound has performed poorly, UK inflation rates are falling faster than markets had expected.

As the UK’s Parliament heads into its summer recess, few market watchers can have a clear opinion of what the Brexit battlegrounds will be. Considering the EU and UK are now four months into a twenty-four month negotiation period, this is more than a little worrying. At the moment the EU certainly have the upper hand, how quickly some clarity can appear will dictate how optimistic the UK’s public can be.

Corporate Releases

This will be a busy week for corporate reporting with almost half of the FTSE by equity weighting reporting over one hundred European companies posting figures and just over a third of the S&P 500 announcing quarterly updates.

Those US banks that have already reported, have seen their shares hit, as investors have been distinctly underwhelmed by what they have seen. If this is not going to be the template for the rest of the US reporting season, we will need to see a distinct improvement in this week’s figures.

Closer to home we will be keeping an eye out for a number of major Swiss based companies. Julius Baer, Roche, Nestle and Credit Suisse. Adding to this local interest, figures will be out from Biogen, Eli Lilly, Amgen, Gilead Sciences, Dow Chemical and Merck.