Synopsis of the week

- The volume of equities traded this week was low as the US took Thursday off for Thanksgiving and enjoyed an early close to Friday’s session.

- The DAX rallied into the close of the week as the chances of Angela Merkel forming a coalition government improved. This was due to opposition SPD leader Martin Schulz confirming his willingness to renew negotiations.

- Thursday saw the Chinese CSI 300 fall by 2.9%, its biggest drop in 17 months, triggered by a sell off in the bond market, this has still left the index up 24% since January.

As is usually the case when the US markets are shut for a day and a half during the week celebrating Thanksgiving, equity trading volumes were low. The ECB President Mario Draghi was again speaking last week and his continued enthusiasm for the improving economic data coming out of the EU has seen EUR/USD climb by almost 3% over the last two weeks.

At the end of last week, the SDP, the major German opposition party, had confirmed that it would come back to the negotiating table. At the time of writing, Angela Merkel had stated that her party would prefer to broker a deal rather than force the German public into another general election. Although there is no resolution to this problem yet, the DAX should be boosted by the progress being made in these discussions.

Last week also saw the UK Chancellor Philip Hammond deliver his latest budget to the House of Commons. Even though he spoke of lowered growth expectations for the UK in the years ahead, he managed to keep this from being the main takeaway from his speech as he announced lowered taxation on property purchases. The Chancellor’s job was to distract the politicians and press from the poor news and considering one well know financial reporter likened it to a “best man’s speech” due to the volume of jokes, we would suggest he succeeded.

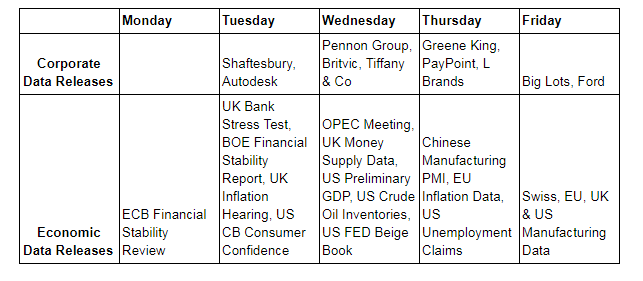

The banking sector across Europe will be under the microscope next week as we will get financial stability reports from both the Bank of England and the European Central Bank. These reports will be in conjunction with the latest European Bank stress test results. The parameters for these stress tests have been made harder this year so it might not only be the Royal Bank of Scotland that struggles this time. We will also be watching out for Banco Santander with its greater exposure to Spain and Asia focused Standard Chartered as it struggles with the tougher lending environment in China.

Vienne will once again become the temporary home for OPEC oil ministers when they hold their next meeting on Wednesday. Oil prices have been strong over the last six months and traders will be hoping that this meeting will not disturb the progress that has been made since early summer.

Thursday and Friday will see Manufacturing data being released for the EU, US, UK and China. As one of the leading barometers for how economies are performing in all of these regions, this data could give equity markets a real sense of direction.

Image by FelixMittermeier from Pixabay