Synopsis of the week

- Having started the year heading higher at an aggressive pace, equity markets spent much of last week giving back those gains.

- Bond markets look to have escalated last weeks equity market sell-off as the possibility of the FED raising rates more than 3 times in 2018 increased.

- Angela Merkel and the SDP still can’t finalise terms to form a new German government as talks continue past Sunday’s deadline.

Press coverage

On Wednesday 31st January Alastair McCaig our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Bloomberg’s FX & Rates strategist Richard Jones to discuss Brexit, Capita and Fed Chair Janet Yellen’s final FOMC interest rate decision.

Click here to listen to the interview on Bloomberg.

Equity markets do not like to move in a straight line for too long and Fridays close saw the S&P 500 record its first 3% correction for over 400 days. Market watchers have for some time been stating how overvalued equities are (for more on equity valuations make sure you read the Corporate releases section) and nervous undertones have been noticeable with traders all through January. We stated at the beginning of the year that most of the underlying factors that had seen equity markets rally so strongly in 2017 were still in place. Only a month on and this still remains the case. Economic data releases are still improving, this latest reporting season has seen corporate data expectations raised and central banks have seen enough positivity to focus on an interest rate rising cycle for the future. The Fern Wealth investment managers will continue to monitor the situation and should we start to see underlying condition deteriorate, we will not hesitate to change our outlook and alert our clients.

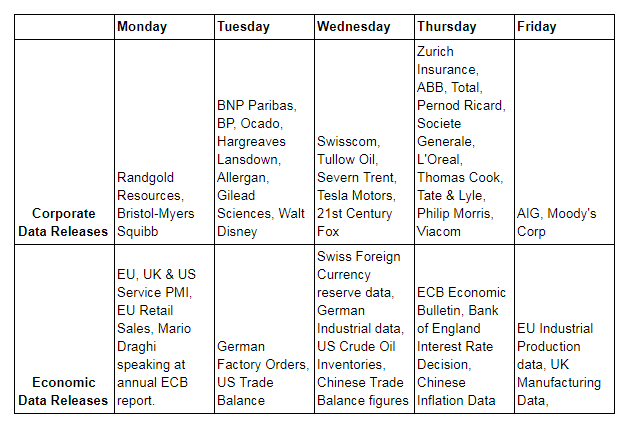

Monday will see Service Data releases for a number of different economic regions but arguably the UK economy has the largest reliance on this sector and will see the FTSE most prone to moves on this release.

In October 2017, the Swiss National Bank announced that they were holding 724.4 Bn Francs worth of foreign currency. Accompanying this announcement, Thomas Jordan the Chairman of the SNB, also confirmed that the central bank would continue to employ a strategy of negative interest rates and market intervention. This helped push the EUR/CHF higher by almost 2% over the rest of the month of October. On Wednesday this week, the SNB is due to update the markets on how much they currently hold and FX traders will also be paying close attention to the comments accompanying this release.

Another Central bank that could move the FX markets this week is the Bank of England as they are announcing interest rates on Thursday. Although we are not expecting rates to change this time around, the possibility of a meaningful extension to the Brexit timeline has increased the prospect of the BOE raising rates this year. Currently, FX futures are pricing in a 50% chance of a second rate rise in May. Should we hear comments from Mark Carney, the Governor, that encourage this thinking, we would expect Sterling to strengthen.

Corporate releases

Regardless of what equity prices did last week, it is worth noting that the combined estimates for 2018 profits for S&P 500 stocks have now climbed to $156.20. This is the highest level since 2012 and a reflection of how good quarterly company releases have been so far this year. Shares in the S&P 500 are currently trading at a Price/Earnings multiple of 22.5 times, if however company earnings in 2018 are as good as expected, this ratio would fall to 17.7 times. This would subsequently mean that shares in this index would be trading much closer to fair value, according to historical P/E ratio valuations. In short, even though share prices might be high, they would be warranted due to the broad profitability of companies.

Photo by Nick Chong on Unsplash