Synopsis of the week

- Equity markets struggled as traders absorbed the latest move from the US in the tit for tat tariff war. Although it may take the Trump administration months to push through these suggested changes, it was a clear example that settlement is still some way off.

- The US Dollar index DXY hit new year highs, back to levels last seen in October 2017.

- The Swiss National Bank kept interest rates unchanged at -0.75% and stated they remained ready to take direct action in the currency markets or increase negative interest rates.

- Last week’s sell-off in the DAX was the biggest we have seen since the end of January. A combination of worries surrounding the automotive industry and the discontent with Angela Merkel’s coalition party drove equities lower.

Press coverage

On Wednesday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Bloomberg’s UK Economy reporter Lucy Meakin to discuss the comments from the ECB’s Central Banking Forum in Sintra, Portugal where both Mario Draghi & Jerome Powell talked about interest rate paths and economic performance.

Click here to listen to the interview on Bloomberg

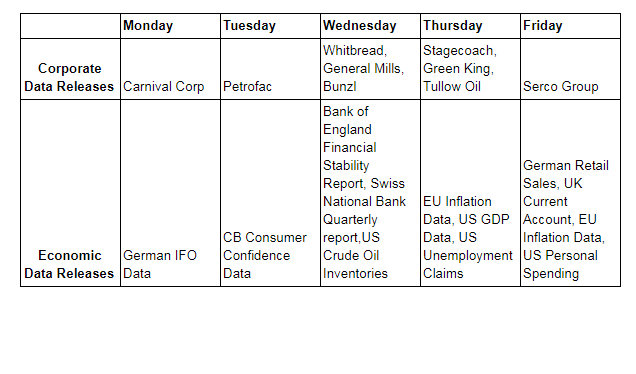

This week, we will hear about consumer confidence, the Bank of England’s stability report, US GDP data and also the Swiss National Bank’s quarterly report. None of these key data releases are likely to be the major driver in equity markets next week. Once again, investors and traders will be watching and waiting to see what new announcements the US Trump administration make. The fundamentals of this war of words are heavily weighted towards the US who imported $500 billion of Chinese goods last year in comparison to $130 billion of goods the Chinese imported from the US. Considering this imbalance, the US certainly have more they can threaten to do and US President Donald Trump does not appear to be the sort of person to shy away from a fight.

The DAX had a poor week partially due to the weakening position of Angela Merkel’s power base but more directly due to another Trump Tweet. Although the President’s tweets are not policy decisions, they do indicate what direction he is thinking. A 20% tariff on European autos would present a sizeable risk to the German economy. As we have seen before, firing the first shot on Twitter has not always resulted in the same action being taken but the DAX has sold off even on the mere threat.

The agreement by OPEC and non-OPEC oil producers to increase market supply has not softened the spot oil prices as much as could have been expected. Although equity markets might be struggling to reflect this, it does show that demand has been steadily rising and at a greater rate than supply. As always, Wednesday’s oil inventory data will be closely watched as the oil-producing nations union is once again tested.

On Thursday and Friday, the EU summit will be taking place. Two years on from the Brexit referendum and it is difficult to say exactly what policies have been agreed on by the UK government let alone successfully negotiated with the EU. GBP/EUR just before the vote was 1.3025 and in the last two years has been as low as 1.0600 before climbing back to today’s current levels of 1.1365. Italy looks set to be the other main topic of discussion at the summit.

We are now moving into the summer months and as equity trading volumes are set to fall, it does increase the chance of higher intraday volatility. Throughout the last quarter, the geopolitical risks to the global economic recovery have outweighed optimism and equities have only been able to partially recover from January’s correction. The fundamentals remain strong but the longer markets remain subdued the more our resilience is being tested.

Image by Gino Crescoli from Pixabay