Synopsis of the week

- US equity markets continued to climb with both the S&P 500 and NASDAQ hitting new highs.

- Trade Wars were again the focus for investors as progress with US & Mexican discussions were tempered by the Trump administration taking steps to implement new tariffs on $200 billion of Chinese goods.

- The revised second-quarter US GDP of 4.2% announced last week is higher than the previously forecast 4.1% and looks set to ensure 2018 will see US GDP grow by 3%.

Press coverage

On Tuesday 28th August, Alastair McCaig, our Head of Investment Management joined Hannah Wise on CNN Money Switzerland to discuss the longest bull run in history, market’s reaction to GAM price drop and the impact of global tensions on markets.

Click here to view the first part of the interview on CNN Money Switzerland.

Click here to view the second part of the interview on CNN Money Switzerland.

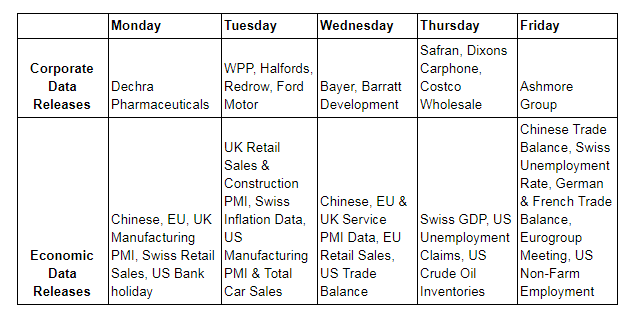

Monday will see the US enjoying its Labour day bank holiday and should ensure that both Asian and European markets have lower trading volumes as well. Although traders might be a little quieter, we are still due to see important Manufacturing PMI data from all economic regions other than the US, who will report 24 hours later. Following on from the Manufacturing releases on Monday and Tuesday, we will also see Service PMI data from all the major regions released on Wednesday. Throw in the European retail sales data, US trade balance and US non-farm payrolls and we are due an extensive set of economic data releases this week.

European markets continue to lag behind the US as political problems prevent investment sentiment from becoming more positive. In the EU, the war of words between President Trump, Germany’s Angela Merkel and France’s Emmanuel Macron shows no sign of easing. Internally, Italy’s new government continues to push for policies that contradict current EU structures which suggests that either Italy or the EU will need to make changes soon. Life for UK Prime Minister Theresa May is even more problematic as the October deadline for agreements with the EU looks almost impossible to meet. Considering March 2019 will be the two year anniversary of Article 52 being triggered, an extension to the current negotiations looks increasingly likely.

Both the S&P 500 and NASDAQ have charged higher after first quarter corrections and increased market volatility. The US Tech sector has certainly played a large part in helping both of these indices climb higher. Amazon is a clear example of this with its share price having now traded above $2,000. The company is currently very close to being valued at $1 trillion and its CEO Jeff Bezos has seen his shareholding now valued at more than $160 billion, making him the world’s wealthiest individual by some clear distance.

Photo by Clay Banks on Unsplash