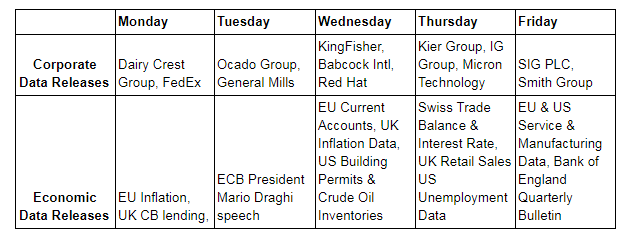

Synopsis of the week

- Although pencilled in to end before the start of 2019, ECB President Mario Draghi used last week’s speech to leave himself with a little wriggle room to extend the current QE program if conditions warranted it.

- As expected, both the European Central Bank and the Bank of England left interest rates unchanged last week. The accompanying comments did nothing to change market expectations of the current path of rate rises from these central banks.

- This weekend was the ten-year anniversary of the collapse of Lehman Brothers and the start of the financial crisis. Since then, we have seen an additional 50,000 new financial regulations being added to G20 nations but will that be enough to prevent another correction in the years ahead…unlikely.

Press coverage

On Thursday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and David Goodman Bloomberg’s economy reporter. In this week’s show, they discussed the European Central Bank and the Bank of England’s interest decisions and the reaction to FX markets.

Click here to listen to the interview on Bloomberg

Last week, we heard from the Bank of England and the European Central Bank and neither increased interest rates or said anything that changed the markets current expectations. At the moment, the FX markets are pricing in a 50% chance of a 25 basis point interest rate rise from the Bank of England in May and a 45% chance of a 25 basis point interest rate increase from the European Central Bank before the end of 2019. Considering the uncertainty hanging over the UK in the shape of Brexit and the issues the ECB has to tackle with Brexit, Italy, Trade Wars and Turkey, it is no real surprise that these European central banks are being so cautious with implementing restrictive measures.

This week on Thursday, we will hear from the Swiss National Bank with its latest interest rate decision. Currently, interest rates are negative 0.75% and the last time we saw an interest rate rise from the SNB was in June 2007. Considering how frequently the SNB state the Swiss Franc is overvalued (and especially against the Euro), it is difficult to see them increasing rates until after the ECB have made the first move, something we are not expecting until the 4th quarter in 2019 at the earliest.

Staying with interest rate decisions, we will also be getting data releases from numerous emerging market countries and with global short-term borrowing rising due to US interest rate increases and the strength of the US Dollar against these currencies, pressure is continuing to build. We have also noted that Oil is back up to its summertime highs, trading at just over $80 a barrel. Technical traders will be looking for some short-term resistance with $81 being the 61.8% Fibonacci retracement level from its $90 fall seen between June 2014 and January 2016. High oil prices also tend to see the US President’s twitter account go into overdrive.

Photo by Richard Tao on Unsplash