Synopsis of the week

- Confidence in European equities took a hit with the dual problems of the UK and Brexit negotiations and Italy and its unwillingness to rebalance its budget proposals weighing on investor sentiment.

- The sell-off in Apple shares and its importance to both the Nasdaq and the Dow Jones saw US equities lower last week.

- Oil prices fell for a sixth week in a row, easing inflationary pressures around the world.

Press coverage

On Wednesday evening, our Director of Investment Management Alastair McCaig joined Bloomberg anchors Jonathan Ferro and Guy Johnson, for the weekly Cable show. This week, they discussed UK Prime Minister Theresa May’s Brexit proposals and cabinet meeting. The show also covered the consequences of this deal on equities and currencies and what market reactions would need to happen in order for politicians to take notice.

Click below to listen to the interview on Bloomberg

Last week saw European investors digesting two major issues surrounding the UK and Italy. Brexit discussions took another step towards reaching a conclusion as Theresa May addressed the House of Commons to announce the final deal the EU had signed off on. Initial reactions were poor as politicians from both the “leave” and “remain” camps voiced their disappointment. On this initial confrontation, the conservative party look unlikely to be able to pass this bill through parliament. With numerous politicians resigning and increasing calls for a new leadership election, Sterling fell heavily into the weekend. Against the US Dollar, it has fallen from 1.3000 down to 1.2850 in the last few days but still has some way to go before hitting the lows of 1.2000 seen after the Brexit referendum in 2016. We also noticed the 2-year gilt yield fell below the Bank of England ’s base rate of 0.75% suggesting the bond markets are expecting more monetary easing in the months ahead. Last week also saw the Italian government present the EU with a budget that had hardly changed from its previous offering. The difference between what Italy wants and what the EU will be willing to permit is sizeable and Italy could find themselves on the receiving end of fines if they do not make substantial changes to this current draft.

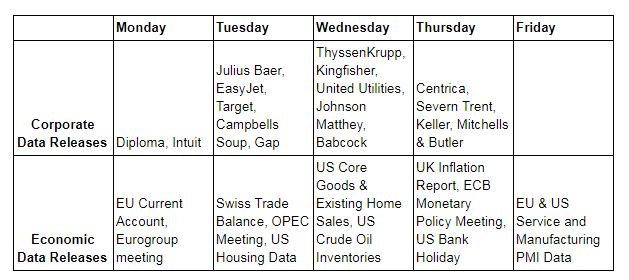

This week, we will be watching out for further developments in London as UK politicians continue to voice their thoughts on Brexit negotiations. It is far from certain that Theresa May will still be the UK PM by the end of the month.

On Tuesday, OPEC members will be meeting and US President Donald Trump should be a happy man following six weeks of selloff in oil prices. In this time, prices have fallen by thirty percent and any worries of oil breaking above $100 a barrel have been put to bed for the time being.

Thursday is a bank holiday in the US as they celebrate Thanksgiving and this is the precursor to Black Friday, the biggest day of online shopping as retailers flood the markets with pre-christmas deals. This is always a particularly important day for the retail sector and turnover can go a long way to dictating how successful fourth-quarter sales are.

Friday will also be an important day for economic releases as we will see the latest Service and Manufacturing PMI data for both the EU and US.

Image by DANIEL DIAZ from Pixabay