Synopsis of the week

- The latest G20 meeting in Argentina has helped ease trade tariff tensions and saw all the attending nations sign off on a mutually agreeable joint statement.

- Fed Chairman, Jerome Powell, stated US Interest rates were “just below” neutral, triggering a bounce in US equity markets and a reassessment of US Dollar strength.

- Robust sales figures following Black Friday and Cyber Monday helped improve investor sentiment to the retail sector.

Last weekend’s G20 summit in Argentina has been an important date on investors’ mind for weeks as many Bulls felt this would be the best opportunity to get global trade negotiations back on track before the end of 2018. Broadly speaking, this has happened and the biggest issue has been the stagnation in negotiations between the US and China. Saturday evening saw the Chinese and US delegations sitting down to dinner together and following the Sirloin steak, Merlot wine and discussions, both delegations have subsequently come out with positive statements. Both parties have agreed to get back around the negotiating table, specifically, the US has agreed to suspend increases to Chinese trade tariffs that were set for the first of January for 90 days while China has agreed to a “very substantial” investment in US Agricultural, Industrial and Energy products. As is always the issue in negotiations, the devil is in the detail and as yet, market watchers are still waiting for more specific details but that should not stop markets from opening in a more optimistic mood on Monday morning.

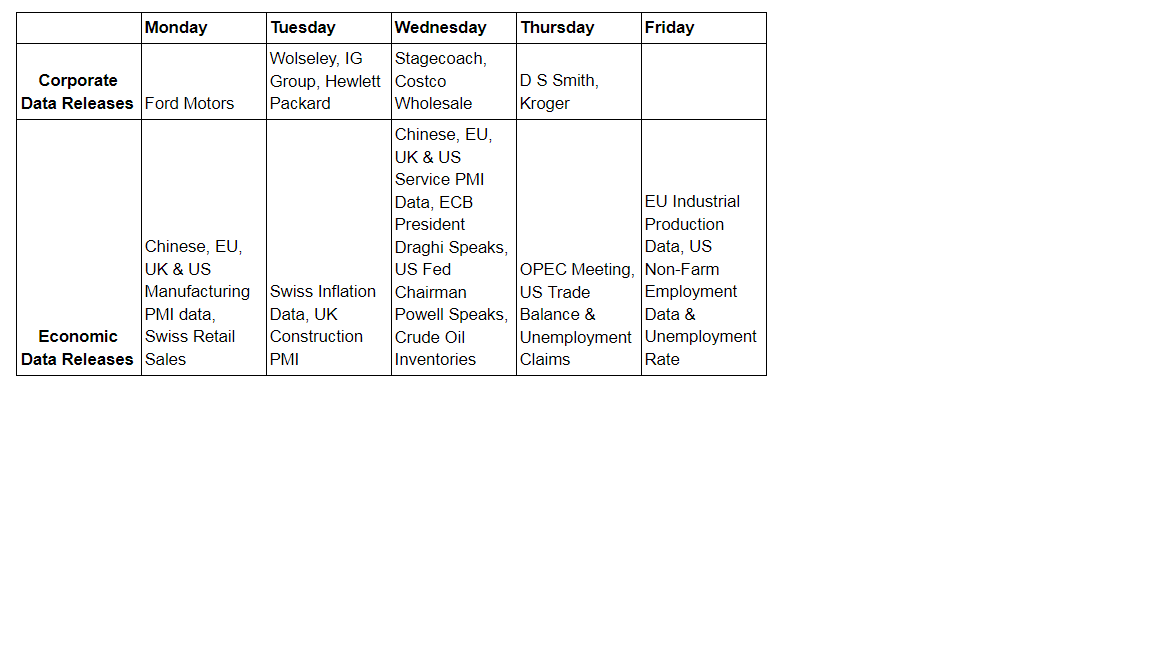

Earlier in the week, US Fed Chairman Jerome Powell stated that the current US interest rate was “just below” neutral. Considering in October 2017, he had stated it was “a long way” from neutral, this represents a substantial shift in Fed thinking. Judging by market reaction, this caught equity and FX traders by surprise sending shares higher while knocking the US Dollar lower. The markets are still expecting two more interest rate increases from the Fed but the chances of a third or fourth now look substantially lower. This week, we are expecting to hear from Mr. Powell again at a congressional hearing where we should get even more clarity on the matter.

On Thursday and Friday, Vienna will once again play host to the latest OPEC meeting and this looks set to be one of the most acrimonious in years. In November, oil prices endured their worst month in over a decade as they fell by 20%. And this is after they had already dropped by 10% in October. The smaller producing nations will be putting the pressure on Saudi Arabia to reduce production levels as they struggle with collapsing profit margins.

In the UK, the parliamentary vote on Theresa May’s Brexit deal is not due to happen until the 11th December but things may well come to a head before then. The Prime Minister has struggled to get much support from her own party for this deal and with the opposition parties having already instructed MPs to vote against it, this looks doomed. Interestingly, the Labour party have now publicly stated a second referendum may be required, an action likely to generate just as much anger as relief with the British public.

Image by <a href=”https://pixabay.com/users/halloweenhjb-5706202/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=2437858″>Herbert Brant</a> from <a href=”https://pixabay.com/?utm_source=link-attribution&utm_medium=referral&utm_campaign=image&utm_content=2437858″>Pixabay</a>

Image by Herbert Brant from Pixabay