Synopsis of the week

- Central banks kept to the script with the US Fed raising rates for the third time this year while the Bank of England and the Swiss National Bank both kept rates unchanged.

- Last week’s EU Manufacturing PMI data was the strongest seen since the summer of 2011 and servicing PMI data for the EU region is also close to breaking multi-year highs. The EU is continuing to enjoy strong economic data releases giving credibility to the 12.4% move the Euro has had against the US Dollar during 2017.

- Last week’s Swiss National Bank Inflation statement noted that the Swiss Franc remained “Highly Valued” and that it was in “no rush at all” to start rate normalization. This confirmed that the SNB were keen to see further weakening in the Swiss Franc in 2018.

PRESS COVERAGE

On Monday evening Alastair McCaig our Head of Investment Management joined host Jonathan Ferro and Bloomberg’s Head FX & Rates strategy for his weekly interview. This week’s discussion covered the UK’s efforts to move on to phase two of Brexit negotiations, Bitcoin’s moves and the latest interest rate decision from the US Federal Reserve.

Click here to listen to the interview on Bloomberg.

This will be the last full week of trading in 2017 and so far this December, US equity traders have enjoyed another Santa rally with the Dow Jones, Nasdaq and S&P 500 all performing well. It will be a tough ask for 2018 to replicate the performance seen in 2017. Even though they look to be somewhat watered down versions of what was originally proposed, the Trump Tax reforms are edging closer to being approved. It would be fair to say that quite a lot of this has already been factored in by the markets. Fed Chair Janet Yellen has now presided over her final interest rate change and in 2018, Jerome Powell will be taking over the chair. The speed and aggression of interest rate changes in the US are crucial in dictating the performance of the economy. Many people view Jerome Powell as a like for like replacement of Janet Yellen but until he has presided over interest rate setting meetings, the markets can’t be certain.

This will be another big week for Bitcoin as the CME (Chicago Mercantile Exchange) will start trading Bitcoin futures on its platform. Up until last week, the financial investment community had to trade the cryptocurrency just like anyone else but this move will now enable them to use a regulated financial exchange. This is yet another step towards cryptocurrencies being more broadly accepted by the financial world. It is unlikely trading volumes will be particularly large, in value terms, when compared to the other commodity futures traded on its platform but psychological, this is a big event. Of course, retail investors are able to use IG, a platform trading firm to gain exposure to Bitcoin or Ethereum and we would be happy to assist clients looking at this avenue of trading.

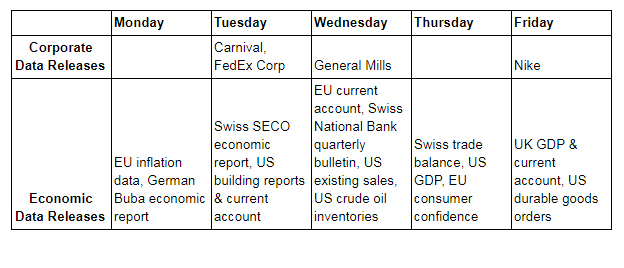

As we are already half way through December, economic data releases are becoming a little less prevalent. The EU will post its latest inflation data on Monday, for much of the last six months this has been hovering around the 1.5% level. This is short of the targeted 2% level but almost no central banks have managed to maintain rates at or above 2%. Wednesday will see the Bank of England Governor Mark Carney having to answer questions in front of a treasury select committee on UK inflation rates, while later in the day we will get the weekly US Oil inventory data. On Friday, UK GDP data and US durable goods round off a relatively quiet week.

Photo by Markus Spiske on Unsplash