Synopsis of the week

- EUR/CHF has traded as high as 1.1720 this week breaking above last month’s highs following encouraging words from ECB President Mario Draghi.

- Central Bankers have dominated the week with twelve different speeches from the heads of the US, UK & EU central banks in only a five day period.

- Only weeks after CEO Jamie Dimon lambasted Bitcoin for being a tool for money laundering, JP Morgan have had their wrist slapped by Swiss regulators for…. money laundering, ensuing more than a few smiles around crypto valley.

Press Coverage

On Wednesday evening Alastair McCaig our Head of Investment Management joined host Jonathan Ferro for his weekly Bloomberg interview. The discussions covered the latest equity market movements, UK Labour market data and the 5% stake Cerberus Capital have taken in Deutsche Bank.

Click here to listen to the interview on Bloomberg

Last week was another soft week for western equity markets. That being said, the major US markets again looked resilient as they closed out the end of this latest US reporting season. European equities had their own issues with Mario Draghi, on several occasions, talking up the strength of the Eurozone and subsequently the Euro. As the Euro has strengthened, export-driven countries like Germany have seen the DAX sell off.

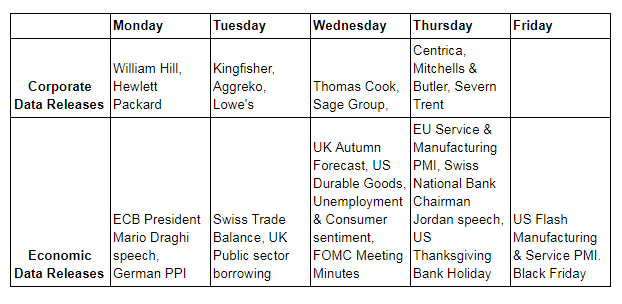

The first half of next week could be quite lively but with the US off on Thursday celebrating “Thanksgiving” and only a half day on Friday, we would expect trading volumes to drop dramatically from then on.

From Monday morning, the Euro will again be monitored for any reaction to statements by Mario Draghi in Brussels on the economy and monetary policy, especially after the influence his words had last week. Tuesday morning will again see the Bank of England Governor being grilled by politicians on the current inflation levels and how he plans to use the interest rate to tackle this. Wednesday should prove to be the busiest day of the week with the UK Chancellor Philip Hammond delivering his Autumn budget to the House of Commons. It is unlikely this will offer embattled Prime Minister Theresa May too many positives to talk about. Also on Wednesday, weekly Oil Inventories data will be closely watched, especially as Oil prices fell last week after having climbed by over 16% in the previous four weeks. Finally, the US FOMC will end the day as they release the minutes from their last meeting on interest rates. Once able to read exactly what was said rather than just speculate on future interest rate decisions, this will give the FX markets more to digest.

The week is rounded off with Black Friday the day after Thanksgiving when the US starts shopping in the run up to Christmas. Like Halloween, this is another trend that has made its way over the Atlantic and many European countries take part. With $3.3 billion spent last year ($1.9 billion online during Thursday) retailers will be expecting another boost.