Synopsis of the week

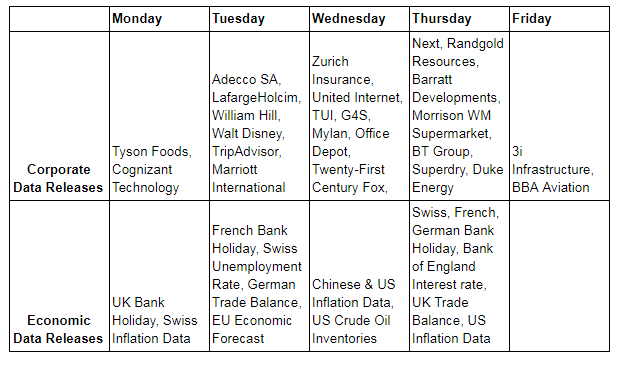

- With the US reporting season almost finished and the European version past the halfway point, corporate data releases remain strong.

- Although European Economic data has cooled from last year, the US continues to charge ahead. Unemployment levels in the US are now 3.9% and this is a 17 year low.

- UK economic worries resurface again, weakening sterling and sending GBP/USD down by 5.6% in a little over two weeks.

Press coverage

On Wednesday 2nd May, our Head of Investment Management, Alastair McCaig, joined Bloomberg anchor Jonathan Ferro and Michael Regan, Senior Bloomberg Editor. On this week’s show, they discussed the Fed’s interest rate decision, central banks paths to rate normalization and the performance of the Euro.

Click here to Listen to the interview on Bloomberg.

This week could be very stop-start for European traders as the UK are enjoying a bank holiday on Monday, a French Bank holiday on Tuesday and France, Germany and Switzerland are all off on Thursday.

It will be a short week for UK equity markets but with the Bank of England set to announce its interest rate decision on Thursday, it could be volatile. Three weeks ago, FX markets were pricing in a 90% chance of a May interest rate rise from the Bank of England and that has now fallen to just a 20% chance. Sterling could be in for yet another tough week.

Wednesday’s US Crude Oil inventories figures will be the last before US President Donald Trump has to make a final decision revolving around the Iranian Nuclear deal. Hanging in the balance is the possibility of sanctions once again being imposed on Iran’s ability to continue to supply oil to the global markets. President Trump’s negativity to this deal has been well known for a long time and the US vetoing the 2015 agreement has already been partially factored in by the markets. With Oil prices back up to $75 a barrel, it is a bit optimistic to expect a jump to $100 if Trump votes as expected.

Corporate data

We have now seen almost 90% of US companies update the markets on quarterly figures and as this season draws to an end, it is worth looking at how they have performed. On average, S&P 500 companies have shown an 8.5% increase in revenue growth. This is particularly encouraging as it shows that sales rather than cost-cutting are maintaining profitability. These figures are the strongest we have seen since 2010. Expectations about US companies remain high and this latest data puts us on course for profit growth of 18.5% in 2018. With the US unemployment level falling to 3.9% as well, this should help maintain the consumer consumption even as interest rates continue to climb.

We have spoken about the strength of the US technology sector on several occasions and our belief that although this sector’s performance has been very strong, it still has more to give. Last week saw Apple announce that they are set to embark on a US$100 billion (no not a typo) share buyback programme, probably due to the benefits of the Trump Tax reforms. Apples good figures and share buying programme have helped its share price higher to $183.83 on Friday’s close. This has seen the FAANG (Facebook, Apple, Amazon, Netflix & Google) shares in the NASDAQ increased to an all-time high of over 27%.

Image by mostafa meraji from Pixabay