Synopsis of the week

- On Wednesday, the Federal Open Market Committee (FOMC) increased US interest rates by 0.25% taking current rates to 2.25%. This was a move that had almost been fully factored in by the FX markets.

- A second member of the Swiss cabinet has resigned in a week as negotiations with the EU over renewing bilateral ties reach crunch time. The reluctance of the EU to recognise the Swiss stock exchange equivalency has been one of the main sticking point.

- Brent Crude prices last week broke above May highs and reached levels last seen in November 2014. This news will just sharpen the US President’s focus on OPEC production levels and is certain to encourage more opinionated tweets from the US Oval office.

Press coverage

On Wednesday evening, our Director of Investment Management, Alastair McCaig joined Bloomberg anchor Jonathan Ferro for his weekly show. This week, they discussed the latest developments surrounding Brexit, the upcoming US Federal Reserve interest rate decision and market expectations for the future rate path along with the consequences to the US Dollar and global currencies.

Click here to listen to the interview on Bloomberg

At the end of the third quarter, we are still on track to see equity markets close out the year higher and once again, it is the US equity markets that are leading the way. A quick glance at what has been the best performing asset class through 2018 has Brent Crude comfortably in front. So far year-to-date, “Black gold” is up by 22% and last week’s moves above the May highs will have technical analysts signposting the next major area of resistance up towards the $89 region. Certainly, with the US economy proving so strong demand is up, however, neither shale oil producers or OPEC have been able to meet this increased consumption with higher supply. At the other end of the scale, the Shanghai Chinese equities have fallen by over 20%; a sell-off that is beginning to look overdone (A point we highlighted when drawing clients’ attention to last week’s FT article).

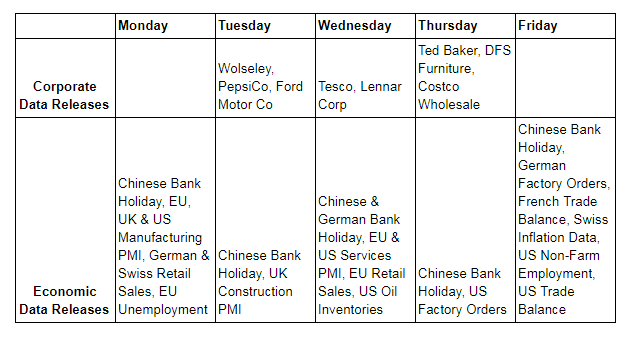

The market’s attention last week was on the anticipated US Fed interest rate rise and arguably, more importantly, the accompanying wording. The wording of this speech would strongly suggest we will see another interest rate rise in December and the three moves higher in 2019 looking increasingly likely too. This week, China will be enjoying a bank holiday all week and the market’s interest will be focused on the UK. Theresa May, the UK Prime Minister, will be heading the conservative parties conference and will be giving several speeches throughout the week. Considering the problems the UK have had with Brexit negotiations lately, the government would have thought the less said the better, this, however, will not be an option. This could be a rocky week for Sterling as FX markets will be analysing every word said by the Conservatives and monitoring the public’s reactions.

Image by Dr StClaire from Pixabay