Synopsis of the week

- As expected, the Swiss National Bank left interest rates unchanged at negative 0.75%. With inflation still very low and the Franc still too strong, FX markets are not expecting to see a rate rise until 2020.

- UK Prime Minister Theresa May’s exit plans were thrown out by EU leaders at last weeks Salzburg summit calling her plan “unworkable”. This leaves little time before next year’s March deadline and once again weakening the PM’s political strength inside the UK.

- Equity markets once again closed the week in positive territory as traders ignored the latest escalation in the Chinese/US trade war of words.

Press coverage

On Wednesday evening our Director of Investment Management, Alastair McCaig, joined Bloomberg anchor Jonathan Ferro and Richard Jones, FX and Rates Strategist, to talk about trade wars, Danske Bank and the possible consequences of Brexit on the English Premiership.

Click here to listen to the interview on Bloomberg

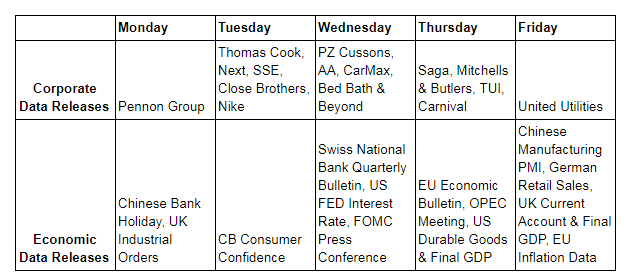

For the last couple of weeks, central bank interest setting meetings have been “much ado about nothing” with the European Central Bank, the Bank of England and latterly the Swiss National Bank all passing on the opportunity to start raising interest rates. This week, it is the turn of the US FED and we fully expect to see US interest rates increase by 0.25% and move to 2.25% following Wednesday’s meeting. As the US economy remains resilient, unemployment remains low and average hourly earnings continue to move higher, we do not expect this to be the last of these moves.

We have pointed out before the exposure that many emerging markets have to the US interest rates. Small and medium-size businesses in these regions are reliant on using the US$ Dollar debt markets to finance their operations. This has had the knock-on consequence of increasing inflation in these countries forcing many of their governments to start rising rates and therefore cooling equities in the process.

We do view China as separate from these emerging markets and less susceptible to the US interest rate issue. China, of course, has its own issues to worry about as US President Donald Trump has focused his attention on them. As Fern Wealth clients will know, we make a point of trying to ensure we look past what is happening in the short term and focus more on where markets will be in the future. With this in mind, it is interesting to see that the UK Financial Times are already writing about how undervalued Chinese equity markets are. As the Trade War discussions continue, we fully expect to see volatility remain and this would not be an area we recommend to low-risk investors. That being said, we do think that much of the negativity towards the Chinese markets have already been fully factored in, especially when we look more carefully at what sectors the sanctions have focused on and the weighting in the CSI 300 Index to these. Although the People’s Bank of China has stated on several occasions they will not devalue the Renminbi to soften the effects of any increased US sanctions, we remain convinced this is a tool they would not hesitate to use if required in the future.

Photo by Claudio Schwarz | @purzlbaum on Unsplash