Synopsis of the week

- The DAX has had a second disappointing week in a row taking the German equity market back down to April levels, although still up 1.6% from the start of the year.

- Nestlé, Switzerland’s largest company has announced further job cuts here as they move Nespresso jobs to Spain, citing the strength of the Swiss Franc as the motivating factor.

- Politics drove the Italian MIB equity market lower in the first half of the week before clawing back the majority of its losses in the second half of the week.

- Better than expected US Non-farm payrolls on Friday once again demonstrated how solid the US economy is.

The Swiss Franc once again rose against the Euro last week and at one point trading below EUR/CHF 1.1400 before bouncing back to EUR/CHF 1.1520 at the end of the week. Although it is Italian politics that are knocking the strength out of the Euro, the Swiss National Bank will be feeling the pressure. When the largest company by market capitalization, Nestlé, announces another round of jobs being moved out of Switzerland and relocated somewhere else in the EU due to the strength of the Swiss Franc, politicians will start taking note. It is announcements like this which should see SNB Chairman Thomas Jordan taking action to weaken the Swiss Franc rather than just talking about it.

Once again, geopolitics was the reason equity markets have been volatile. Italy has struggled to form a government and sentiment towards the country leaving the currency union with the EU has grown. Italian politics have always been volatile even at the best of times but equity markets are currently more susceptible to these problems. We are still a long way away from the Italian people being able to return to the Lira and this course of action still looks less likely.

In contrast to the speed with which traders are willing to factor in negative newsflow out of Italy, they appear almost ambivalent towards good US economic data releases. Friday saw US Non-Farm payroll data come in stronger than expected. More impressively though the US unemployment levels have now dropped to 3.8% and average hourly earnings have also risen. With more people working and salaries increasing, it gives even more support to the last Corporate reporting season that saw company profits rise due to increased sales rather than cost-cutting.

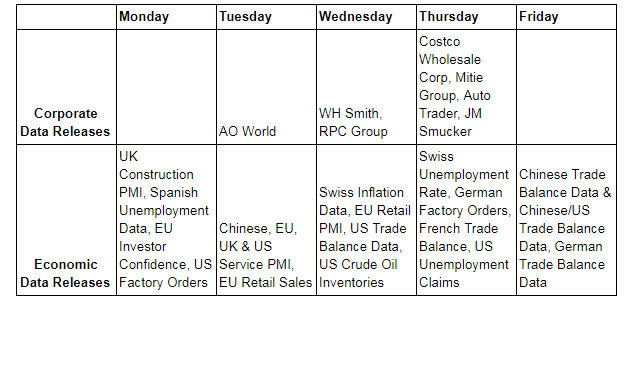

Looking ahead to the impending economic data releases, normal circumstances would dictate that Tuesday’s Service sector PMI data releases for the EU, US & UK would be the highlight of the week. However, current market volatility has seen fundamental data releases take a back seat to geopolitical events as investors remain nervous. With this being the case, I suspect the main drivers of the week will be Wednesday’s US Trade Balance Data and Friday’s Chinese Trade Balance Data, especially China’s China/US Trade Balance announcement on Friday. Both of these Trade Balance releases will probably prove to be too irresistible for US President Donald Trump not to tweet about and once again see the topic of trade wars at the forefront of investors minds. Although Presidential tweets will be worth looking out for, we will also be watching the US Dollar now up over 5.3% in the last couple of months. This run of strength could be set for a correction if the US Trade deficit were to worsen on Wednesday.

Last week, we highlighted the risk to emerging markets being caused by US interest rate rises and the knock-on effect to inflation. On Wednesday, markets are expecting the Indian Central Bank to raise interest rates for the first time in four and a half years. Although the Indian Rupee is not facing the same pressure as the Turkish Lira, it does highlight our reason for caution when investing in emerging markets.