Synopsis of the week

- Last week saw markets continue to behave erratically as traders weighed Trump policy news and rising rate expectations against increasingly impressive economic data releases.

- New FED chairman Jerome Powell delivered a strongly upbeat message on the state of the US economy seeing FX traders speculate that we might see four and not three interest rate rises during 2018.

- Five months of German political stalemate finally comes to an end as the SDP vote to form a coalition with Angela Merkel’s Conservative party.

Press coverage

Federal Reserve Chairman Jerome Powell won’t want to “rock the boat” during his House and Senate testimony this week, said Alastair McCaig, Director of Investment Management at Fern Wealth. He told Daybreak Europe’s Caroline Hepker that markets will be looking for any clues as to if there will be 3 or 4 rate hikes in 2018.

Click here to Listen to the interview on Bloomberg.

Global equity markets continue to perform erratically as investors remain nervous following February’s market correction. Last week saw two events create debate about market conditions in the future. The first was the particularly upbeat message that the new FED chairman Jerome Powell delivered at the semi-annual monetary policy report. The tone of his speech saw markets factor in more than a 25% chance of a fourth interest rate rise in the US during 2018. The second event to cause markets unrest was the announcement from US President Donald Trump that he was going to introduce new tariffs on steel and aluminium imports. Although these account for less than three percent of US consumption, it did start the debate of what other tariffs would the Trump administration look to introduce in the weeks and months ahead.

At the time of writing, results were still coming in from the Italian elections. Exit polls were available (although they have not been overly accurate predictors of late) suggesting that no one party was even close to a majority and that any coalition government that could be formed would need multiple parties to get the required seats. The only certainty coming from these results is that Italian political uncertainty remains.

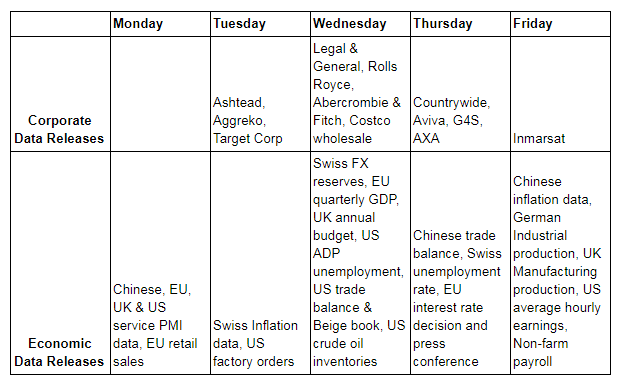

Markets will have numerous economic data releases to digest this week with Services PMI data being released by China, US, EU and UK on Monday. Certainly, the makeup of the UK’s GDP is heavily weighted by the service sector and this will be particularly important for them. This week will also see Swiss inflation data, FX reserves and unemployment figures released through the middle of the week. Although EU interest rate decisions will be announced on Thursday, we expect little chance of any move but will be watching for any change in the tone of wording. Rounding off the week, we have the US Non-farm payrolls. Much like a Trump speech, these do have the ability to fluster the markets.

Corporate releases

Now that a substantial number of European companies have reported, the corporate diary is beginning to look a little thin. Both Aggreko and Ashtead report on Tuesday and with large parts of their annual revenue being derived in the US, they could still impress. Both FTSE companies could benefit should the US actually start to turn their attention to infrastructure spending, so it might be interesting to see what their forward guidance is indicating.

Photo by Maxim Hopman on Unsplash