Synopsis of the week

- The Bulls were once again in control of the US markets as the S&P 500, Nasdaq and the Dow all set new highs during the course of the week.

- Last week’s meeting in Vienna saw the OPEC nations agreeing to cut production through to 2018. This unified action helped send Oil prices to two and a half year highs.

- UK banks passed more stringent stress tests proving they could handle recession, a housing market collapse and rising unemployment levels. This was the first time that all the major UK lenders were able to pass the test since they were introduced in 2014.

Press Coverage

On Wednesday evening Alastair McCaig our Head of Investment Management joined host Jonathan Ferro for his weekly Bloomberg interview. The discussions covered the latest developments in Brexit negotiations, the structure of bonuses at Barclays bank and the latest testimony from Fed Chair Janet Yellen.

Click here to listen to the interview on Bloomberg

It looked like the Bulls in America were making up for lost time after the previous short trading week due to the Thanksgiving holiday celebrations. We saw all three major US equity markets hitting fresh highs during the week’s trading. Friday’s news surrounding the Senate’s investigation into Donald Trump and Russian influences did take a little of the shine off the markets performance.

We have now moved into the final month of the year and with Saturday’s news that the Senate have voted through the Trump administrations tax reforms, we could see US equities receiving another boost. Considering this would be the largest change to the US tax system in almost three decades, it might be a little optimistic to hope that this will be pushed through in 2017 but it does mean these reforms have now taken a large step in the right direction.

The UK Prime Minister Theresa May will again be in Brussels on Monday to attend the latest EU Eurogroup meeting and more specifically have lunch with EU President Jean-Claude Juncker. Progress in Brexit negotiations has been painfully slow and the pace and direction discussions between the EU’s Michel Barnier and the UK’s David Davies is sure to be one of the most prominent topics. If the May and Junker lunch party can agree on a final divorce bill then negotiations might move on to the next stage. If not, the UK might once again be looking at a hard Brexit.

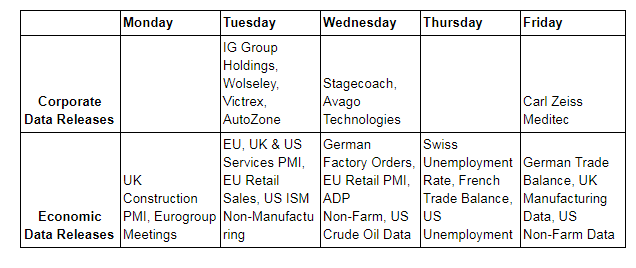

Tuesday’s Economic data releases will be dominated by news on the service sector for the EU, US and the UK. Although important for all three, it makes up a far greater percentage of the annual GDP for the UK and much of it revolves around the financial sector.

On Friday, we will see the latest US Non-Farm payroll figures along with average hourly earnings. At present, the FX markets are factoring in another interest rate rise in the US on Wednesday 13th December. It would require some truly awful data releases for this to change and Friday’s data is arguably the biggest hurdle that needs to be cleared between now and then. This week could see the US Dollar once again looking strong following progress on Tax reforms and should Friday’s Non-farm payroll impress, we could see even greater momentum for the greenback.