Synopsis of the week

- Markets enjoyed some resilience last week as the S&P 500, Dow & Nasdaq all closed the week up by over 2.4%.

- Three-quarters of the way through the reporting season and US equities look set to record their strongest profits growth for eight years.

- The Trump twitter account suggested the G20 would see substantial progress in trade discussions between the US & China and gave equity markets a boost.

Press coverage

On Wednesday evening, our Director of Investment Management Alastair McCaig joined Bloomberg anchor Guy Johnson and Bloomberg opinion columnist Marcus Ashworth, for the weekly Cable show. This week they discussed how equities had performed in October, what to expect from the Bank of England on Thursday and the latest developments in Brexit negotiations.

Click here to listen to the interview on Bloomberg

October was not a good month and the first week in November has already given investors more cause for optimism. As we said in last weeks notes, we did feel the October correction was overdone and too much focus was being placed on less optimistic forward projections rather than the impressive quarterly results. From time to time, corrections are required by the markets to help re-set investor attitudes to where the fair value lies. Before looking ahead, it is worth reminding ourselves that this reporting season is set to see the third quarter of 20% plus growth in earnings in a row and unemployment levels remain low while earnings continue to grow. Last Thursday’s conversation between Chinese President Xi Jinping and US President Donald Trump gave markets a boost as both leaders reported progress in trade discussions.

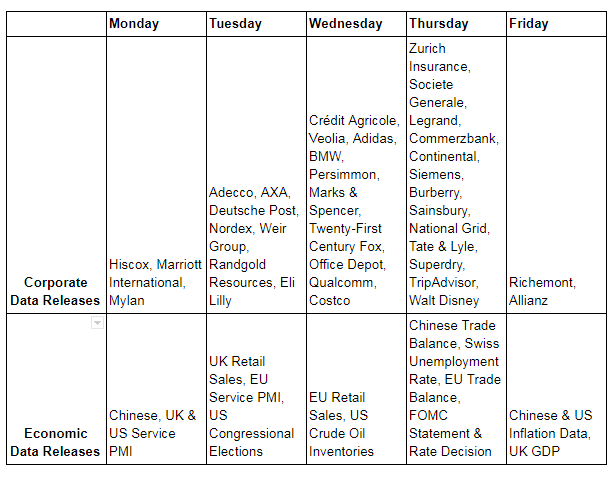

Looking at the week ahead, Tuesday’s US mid-term elections are the biggest event of the week. Currently, the Republicans enjoy a majority in both the house and the Senate, however, markets are factoring in a swing towards the Democrats. We have of course all learnt assuming the Trump team will lose an election is far from a certainty. Strangely enough, history suggests that whatever the outcome of these mid-term elections, the markets will bounce. Certainly, this has been the case in the last five mid-term elections where a wide array of success for the incumbent parties has resulted in markets moving higher afterwards.

Later this week, on Thursday, we will hear from the FOMC. We are not expecting any rate change but with last weeks strong Non-farm employment data, we do expect Fed Chairman Jerome Powell to maintain his assertions of a rate rising policy in order to combat inflationary pressures. More talk of rates being increased could well see more negative comments from the Trump twitter account but this is unlikely to sway the voting members of the FOMC.

Sterling remains undervalued in the long term however it did receive a boost last week as markets started pricing in an agreement being reached between the EU and the UK government in the run-up to the next meeting on the 21st November. It is not in either parties interest for a hard Brexit outcome and as we edge ever closer to the final deadline in March 2019, we expect both sides to show a little more flexibility in order to prevent this from happening.

Photo by Stephen Dawson on Unsplash