Synopsis of the week

- The Swiss National Bank confirmed they remain poised to use currency intervention should any strength in the Swiss Franc materialize.

- ECB rate rise remains some way off as President Mario Draghi confirms they will only start when we are “well past” the end of the current Quantitative Easing scheme.

- Relations between Russia and the UK deteriorate as investigations into the poisoning of an alleged Russian spy on the British mainland point towards direct Russian action.

Press coverage

On Monday 12th March, Alastair McCaig, our Head of Investment Management joined Martina Fuchs on CNN Money Switzerland where he chatted about the current market conditions, expectations for interest rate increases in the US, Chinese banks and what to expect from the Swiss National Bank later in the week.

Click here to watch the interview on CNN Money Switzerland

On Wednesday 14th March, our Director of Investment Management Alastair McCaig joined Bloomberg anchor Jonathan Ferro and Tim Craighead, Senior European Strategist for Bloomberg Intelligence, about Theresa May taking diplomatic action against Russia, comments from ECB President Mario Draghi, and China’s trade tensions with the U.S. Click here to listen to the interview on Bloomberg.

Click here to Listen to the interview on Bloomberg

Last week saw the Swiss National Bank Chairman, Thomas Jordan, confirm the Swiss Franc is still overvalued and the bank remains poised to take action if required. The EUR/CHF spent much of last week floating around the 1.1700 level. Although the Swiss franc has weakened from its early February strength, it is still over 2.5% away from the 1.2000 levels that the SNB had previously supported it at. The second half of 2017 saw the Euro strengthen because of improving economic data coming out of the EU. As this momentum has dried up, we will be closely monitoring the SNB to see if they do finally feel for action rather than just talking about interest rate changes or direct monetary intervention in the currency markets.

The Swiss National Bank also made reference to the Swiss housing market stating “Owing to the strong growth in recent years, this segment, in particular, is subject to the risk of a price correction over the medium term”. At Fern Wealth, we believe there is a place for properties in a well-balanced investment portfolio for clients but this is another clear signal the SNB are worried about the growth of valuations and expect a correction in the Swiss housing market to materialize in due course.

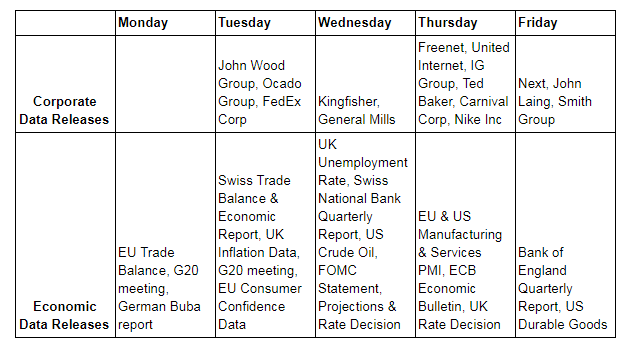

Monday and Tuesday will see finance ministers descending on Buenos Aires for the latest G20 meeting. US treasury secretary, Steven Mnuchin, will be in high demand as most ministers will be eager to discuss what other tariff battles the Trump administration will be looking to focus on next.

Central banks and interest rate decisions will be the biggest focus of the week with US FOMC expected to increase the interest rate by 25 basis points to 1.75%. Rather than the increase itself, most analysts will be dissecting the accompanying statement in an effort to gauge how many other increases we should expect over the rest of the year. The currency futures market is currently pricing in three but depending on how dovish the tone of the announcement is, this could change to four. Hot on the heels of the US rate decision, we will hear from the Bank of England on Thursday. This, however, is less likely to move the markets as we are not expecting another increase and might not even see any of the 9 strong committee vote for change at all.

Photo by Claudio Schwarz | @purzlbaum on Unsplash