Synopsis of the week

- Late rally on Wall Street sees Dow Jones Industrial Average sent to 11th successive record closing high on Friday which makes it the longest run since 1987.

- Dax flirts with 12,000 but Europe sells off on Friday’s initial US weakness. Futures marginally positive for Monday’s open.

- Currencies were mostly flat with positive gains in Gold hitting 3-month highs reflecting some nervousness ahead of events this week.

The Week Ahead

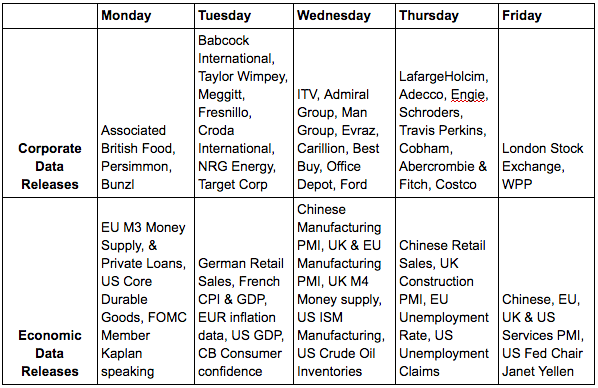

Economic Data

Tuesday will see global investors closely watching Donald Trump’s address to US Congress. Against a backdrop of equities in record territory, investors will be keen to see further details on US tax reform and other fiscal measures to maintain the ‘Trump Trade’ and when these might be implemented. Something greater than 140 characters on Twitter would be most welcome to Congress no doubt.

The dollar will be in action this week with Thursday’s Beige Book being announced. This provides evidence of the state of the US economy from the 12 regional branches of the Federal Reserve and is something that is closely monitored when Fed discussions take place. At the moment there is only a 22% chance of Fed raising rates next month (with the smart money saying June is more likely) according to futures markets. But with speeches from a handful of Fed voting members this week, things could change quickly especially if we get a punchy Trump address to Congress. Watch this space.

Corporate Releases

We are well into the swing of things with the latest raft of companies releasing updates as can be seen below. A few interesting picks from our perspective would be housebuilders Persimmon & Taylor Wimpey giving demand post-Brexit.

The well run WPP also post their update on Friday and as the largest advertising agency globally is often considered a leading indicator by the market. This is largely down to WPP’s clients and their confidence in advertising spending.

(Image by forcal35 from Pixabay)