Synopsis of the week

- Last weeks speech from President Trump to congress might not have packed a political punch but it certainly contained everything the markets wanted to hear as the Dow kicked higher.

- Positive sentiment from the US helped the Dax break above 12,000. With the focus now turning to the ECB’s speech this week coupled with German factory orders, this might not be a level it can hold for too long.

- This week will also see the release of the US Non-farm payroll figures. Although not technically the first Friday of the month (when they are normally released) it will never the less cast a little more clarity on the expectation levels for a US rate rise later this month.

The Week Ahead

Economic Data

Last weeks speech from US President Donald Trump might not go down as an all time classic but it certainly had all the major characteristics the equity markets were looking for. The fact that he referred to an Infrastructure spending budget that would start at 1 Trillion was taken as a signal that once again his pre-election promises were being kept. The market of course celebrated as governmental budgets only ever get bigger they never shrink. This news helped kick equity markets higher and should also ensure that any future claims from this administration revolving around spending are likely to be given the benefit of the doubt.

European markets also enjoyed a surge following the US President’s speech but this week will see traders focusing on issues a little closer to home. The European Central Bank is due to speak and President Mario Draghi will no doubt be facing some tough questions in the ensuing Q&A session. With inflation now comfortably above 1.5% and edging closer to the targeted 2% the need to continue with the current quantitative easing scheme is reduced. Of course the inflationary needs might be ebbing away but the dependency of the equity markets on the steady drip feed of cash looks as strong as ever. The stability of equity markets was never the target but continuing to support it might become the more pressing issue rather than inflation itself.

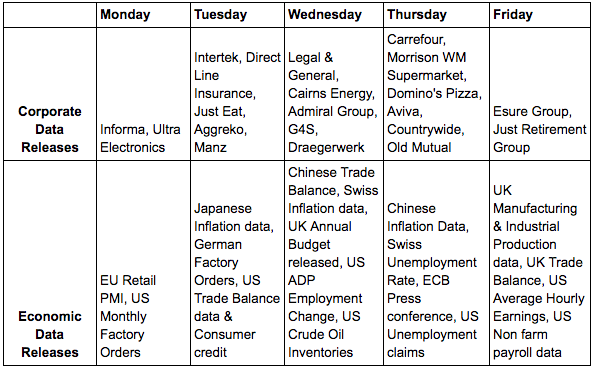

A week is a long time in the markets and last weeks call of a 22% chance the Fed would raise benchmark rates this month has jumped to 88% by mid afternoon Friday. On Friday the 24th February GBP/USD closed at 1.2464, by last Friday 3rd, it had closed at 1.2295 almost 90 pips higher than the low of the day. The FX markets have made their belief clear, this Friday’s Non-Farm payroll figures and accompanying Average hourly earnings are going to give the green light for the US Fed to raise rates in March.

Corporate Releases

This week will see food retailers again in the headlines as Carrefour and William Morrison release trading updates. Considering that increased inflation has a habit of eating into shoppers monthly budgets and reducing retailers profit margins, the market’s expectations are that the food retailers will continue to underwhelm investors. Financials are also set to feature heavily in the weekly trading floor chatter as Direct Line, L&G, Admiral Group, Aviva & Old Mutual are all set to update the markets on performance. Even with the cycle of interest rates moving higher many of these financial houses have yet to capture investors enthusiasm.