Synopsis of the week

- The Macron win has eased short-term fears about France and the stability of the European Union, at least until the next major European election.

- Worse than expected Services and Manufacturing data out of China have been the catalyst for commodity prices to crumble over the week.

- The last three weeks have seen Oil prices tumble by almost 15% with Thursdays 4% fall the most aggressive move.

- UK Prime Minister Theresa May and European President Jean-Claude Junker have escalated the rhetoric about Brexit.

- The German DAX has once again set new all-time highs powered by impressive quarterly corporate data releases.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s Jonathan Ferro to discuss the markets’ reactions to French election debate and the weekends voting and the latest UK economic data releases.

Click here to listen to the interview on Bloomberg

Fern Wealth Seminar

Following on from the success of our first seminar we are pleased to announce that we are inviting clients and prospects along to our offices for an informal evening of conversation and discussion on Tuesday 23rd May. Fern Wealth directors Steven Flintham and Alastair McCaig will be revealing “Why everyone should be investing in funds and how to get started” CLICK HERE for further details and to reserve your place.

Following on from the success of our first seminar we are pleased to announce that we are inviting clients and prospects along to our offices for an informal evening of conversation and discussion on Tuesday 23rd May. Fern Wealth directors Steven Flintham and Alastair McCaig will be revealing “Why everyone should be investing in funds and how to get started” CLICK HERE for further details and to reserve your place.

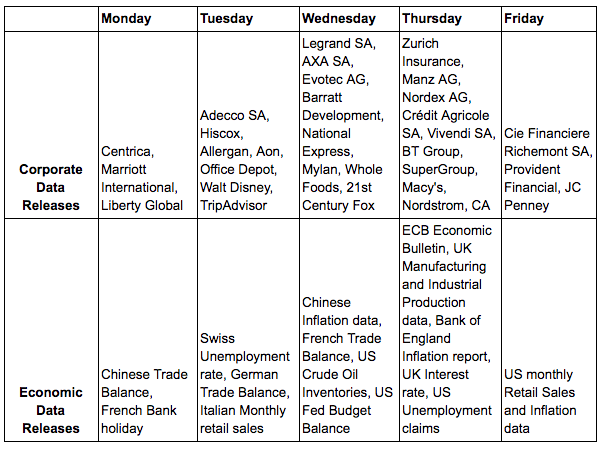

The Week Ahead

Economic Data

Once again this week has seen strong moves in the DAX, CAC and EuroStoxx 50 as European political worries appear to be dissipating. Last week saw possibly the most bitter and acrimonious leadership debate ever as Emmanuel Macron and Marine Le Pen held a live debate on French TV. The general consensus following the debate was that Mr Macron has done enough to ensure he is elected over the weekend.

Our take on the Macron win is that equity markets will be happy without the threat of a “FREXIT” vote that Le Pen wanted to introduce. More generally Macron is more of a known quantity and is less likely to introduce wild or outlandish policies and this is good for equity markets. As far as the French economy is concerned we could see a prolonged period of stagnation as Mr Macron will find it difficult to push through many of his own ideas. 25% of the population did not vote and of those that did 10% handed in blank ballot papers, these statistics alone show that the nation is far from fully unified behind the Macron party.

Last month’s US Non-Farm payroll data was shocking seeing roughly half as many jobs being created as had been expected. This month’s data, however, has beaten expectations and ensured that markets are still factoring in a 90% chance of further 0.25% rate rises by the FOMC in June.

Corporate Releases

In just under two weeks of quarterly corporate reporting in Europe, just over 40% of companies have updated the markets. Of those that have reported 74% have beaten earnings expectations and 82% have beaten revenue expectations. These solid corporate figures will have helped contribute to the performance of the DAX as it has once again set a new all-time high over the week.

We will continue to see the big European corporate names reporting quarterly figures next week with Swiss firms Adecco, Zurich Insurance & Cie Financiere Richemont standing out along with AXA, Legrand, Credit Agricole & Vivendi from France.

Marriott International is still in the process of integrating Starwood Hotels following this acquisition in the second half of 2016. The two companies combined have created the world’s largest hotel company. The report on revenues over the last quarter and expectations for the year ahead should still be considered an interesting barometer of the global public’s appetite for spending.