Synopsis of the week

Yellen sidesteps the option of surprising markets at Jackson Hole, triggering last Friday’s afternoon sell off.

The Fed’s comments that the case for a rate rise before the end of the year has strengthened, suggests that one is coming. Of course Christmas is coming too and it will be interesting to see which turns up first.

Economic data released around Europe over the week has failed to prevent the second successive week of declines in the CAC, DAX & FTSE.

Will a UK bank holiday and short trading week for the FTSE coupled with US Non-Farm payrolls prove enough to kick start investor enthusiasm?

The week ahead

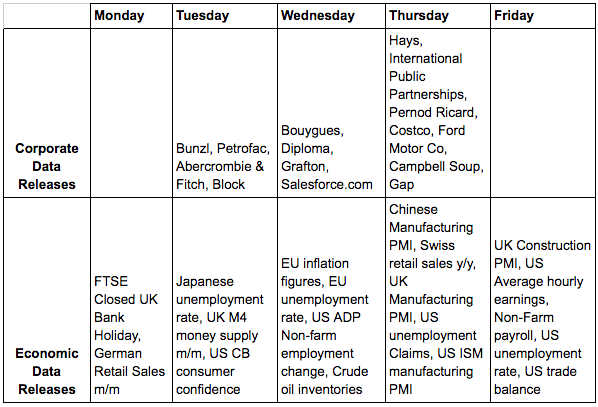

Economic Data

Expectations of sunny weather in London should ensure that what little business the city of London was going to be executing in the global markets on a Bank Holiday Monday will be even less than expected.

When London is shut the rest of Europe tends to take its foot off the gas too and Tuesday’s monthly UK M4 money supply data could be the first economic data release to give equity markets any sense of direction.

As the week progresses economic data gets a little more interesting and Wednesday will see EU wide inflation figures and unemployment rates. Across the Atlantic the US ADP employment data and the increasingly important US Crude Oil inventories data might well enliven the afternoon trading session.

As European traders arrive at their desks ahead of Thursday’s trading session the latest Chinese Manufacturing PMI data will be waiting for them giving traders a snapshot of how the world’ s largest commodity consumer is fairing.

After much weaker than expected July UK Manufacturing Data month traders will be looking to see if the UK can bounce back or if the contraction has worsened. Having fallen off a cliff following the Brexit vote, expectations for the latest UK Construction data are for even more contraction, with no clear path for extraction from the EU this could be the template for some time to come.

The first Friday of the month brings with it the volatility inducing US Non-Farm payroll releases. Following the last two months’ readings of over 250,000 jobs created markets have lowered expectations for this month down to 186,000. As ever the reliability of theses figures is always somewhat debatable given the speed with which they are produced but as the earliest indication of how the US employment scene is looking, they are closely followed.

Although not an economic data release it is worth being aware that Spain looks to be heading for its third general election in less than a year as current incumbent Prime Minister Mariano Rajoy looks set to fail in his attempts to form a new coalition government. What signals this sends out to the rest of the Eurozone will be closely watched especially as both France and Germany hold general elections in 2017.

Corporate releases

French CAC traders will be watching more carefully than normal as Wednesday see’s Bouygues post half yearly figures and Thursday has Pernod Ricard releasing full year data. Other notable releases on Wednesday include international recruitment firm Hays in the UK. Any Brexit update from management would be closely analysed by the market with European jobs confidence always being a leading indicator. And in the US Campbell Soups, Gap and Ford Motor Co.

A little further afield two of China’s big four banks, the Bank of China and the ICBC will be posting figures next week and squeezed margins along with volatile home markets look set to ensure that previous years performances are unlikely to be met. Could this lead to further weakening in the Global equity markets?