Synopsis of the week

- The Trump administration’s target of a reduction to 15% for the Corporate tax was what the markets wanted to see but the details about how they would achieve that were unconvincing.

- The Swiss National Bank discusses further rate cuts and currency market intervention.

- The first round of French elections are out the way and Le Pen and Macron are through to Sunday, May 7th final vote. All the polls are making Macron the clear favourite.

- Sterling has continued to strengthen over the week while the US Dollar has struggled to hold its value as the disparities between what Donald Trump says and what he does remain.

Fern Wealth Seminar

Following on from the success of our first seminar we are pleased to announce that we are inviting clients and prospects along to our offices for an informal evening of conversation and discussion on Tuesday 23rd May. Fern Wealth directors Steven Flintham and Alastair McCaig will be looking at “Why everyone should be investing in funds and how to get started” for further details and an opportunity to reserve your place please go to our seminar landing page here.

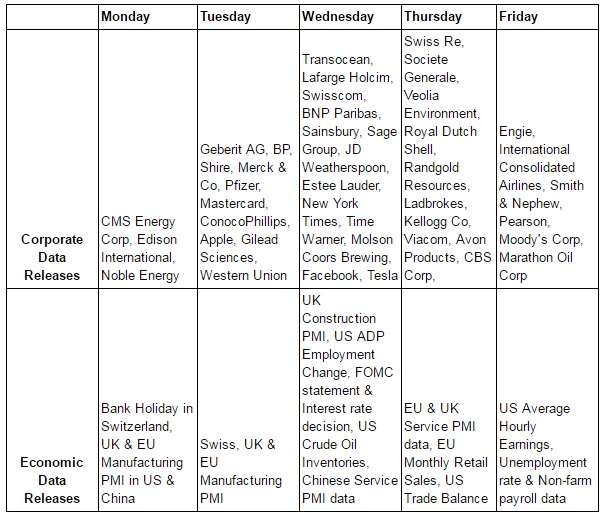

The Week Ahead

Economic Data

The President of the Swiss National Bank Thomas Jordan spoke at the end of last week. His message was clear the SNB still feel that the Swiss Franc is overvalued and a combination of negative interest rates and currency market intervention would be used to help manage the situation. We have long advocated the benefits of utilising the current strength of the Swiss Franc by investing in Euro (or other currency) denominated products and this latest news does not change our thinking on this positive benefit that Swiss Franc earning investors have. The irony of these latest comments to discourage buying into Swiss Francs has not been lost on us especially as last week saw the Swiss 50 Franc note being voted global banknote of the year.

The markets certainly believe that the Trump administration what to bring reforms to the medical system in the US and that they want to aggressively cut the corporate tax rates. The problem is not in what they are targeting but in what they will be able to achieve. The previous administration suffered as they did not have both the support of both house and the senate. This time round the Republicans do have both but doubts still persist.

European equity markets have enjoyed a period of calm as opinion polls show a healthy lead for French Presidential candidate Emmanuel Macron suggesting Marine Le Pen will need a huge upset to win the second vote on Sunday 7th May. Over the Channel in the UK Conservative leader Theresa May also holds a sizeable lead in the polls. This lead, however, might have more to do with the general perception of the opposition leader Jeremy Corbyn rather than anything else. Both in the UK and France, the political scene looks to be stable and that has helped reduce the worries global investors had at the beginning of the year about the political stability in Europe.

The week ahead will be a short one with almost all of Europe off on Monday enjoying a May day bank holiday. The rest of the week will, however, be packed. We will see releases of both Manufacturing and Services PMI data out for Europe and China. Over in the US this week we will see the latest US interest rate decision, the rate is unlikely to change but the accompanying comments from the FOMC might make clearer the committee’s thinking for the rest of the year. This all leads up nicely to the latest US Non-farm payrolls data due for release on Friday.

Corporate Releases

Tuesday will be a big day for the drug and biotechnology sectors as Shire, Merck, Pfizer and Gilead Sciences all report quarterly figures. Swiss quoted company LafargeHolcim will be an interesting company to look at their figures as they are a global building material and construction business with exposure to the North American markets as well as Europe and Asia. As the world’s largest cement maker it is a useful tool for assessing demand for global construction.

On Tuesday Apple are due to report while on Wednesday Facebook are expected to come out with their quarterly figures. Between them, these two companies represent roughly US$1.12 Trillion of market capitalization, certainly enough to give markets a good boost or knock depending on how positive they are.

Image by Doris Jungo from Pixabay