Synopsis of the week

- As President Trump has struggled to get his plans for healthcare approved, markets have begun to question his ability to deliver on infrastructure spending too.

- A week closer to the French elections and Europe still has worries about far-right parties gaining a larger say in future policies.

- The UK and EU gear up for Theresa May’s anticipated triggering of article 50 on Wednesday.

- Commodity prices fall on US infrastructure spending concerns.

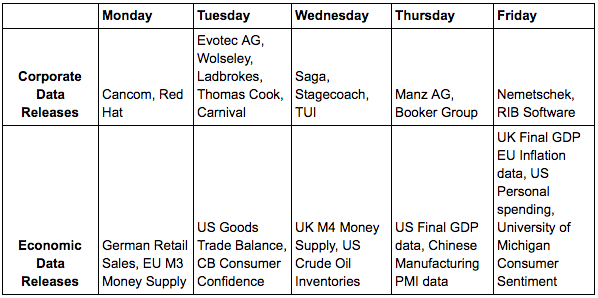

The Week Ahead

Economic Data

Economic data releases in 2017 have been seen more as benchmarks needing to be met rather than catalysts to kick markets higher. Last week has once again shown that inflation is rising around the world and the argument for increasing interest rates is finding a stronger voice. Most of the economic data released has been solid but not spectacular. The exception to that being the French and German manufacturing and services PMI data.

The UK’s Prime Minister Theresa May is expected to finally trigger Article 50 on Wednesday. This will be the UK’s official notification to the European Union they will be leaving and the start of a two year countdown to separation. In the history books this will no doubt be a momentous occasion but as far as the equity markets are concerned this has been factored in for some time and Thursday will probably just be business as usual.

Equity markets in the US and then subsequently around the globe have fallen away as US President Donald Trump has struggled to push through his changes to the US healthcare system. The question now circulating through the markets is how successful will he be in achieving his plans to spend over $1 trillion on infrastructure upgrades and Tax reform changes.

Commodities have also played their part in the way equity markets have performed. The weakness in the US Dollar has coincided with US Crude Oil prices dropping from $55 down to levels just below $48. Copper, a leading indicator of manufacturing has also drifted lower falling by just over 5% to $26.50

Corporate Releases

We are still in one of the quiet periods for corporate data releases. The European-focused travel industry will come under the microscope however as Thomas Cook, Saga and TUI all release data. It will be interesting to see if any of the companies comment further on the recent security changes to electronic devices taken on flights.