Synopsis of the week

- With the opposition parties struggling for unity and the Conservatives holding a very comfortable lead in opinion polls, Theresa May has decided to call for a general election in the UK.

- FX markets have quickly decided that the short term chaos of a general election is outweighed by the longer term stability that a healthy Conservative majority in the house of commons will offer triggering an aggressive jump in Sterling strength.

- The added strength in Sterling resulted in weakness in the FTSE owing to most of its components deriving their income from outside the UK.

- The International Monetary Fund (IMF) has increased its expectations for Global economic growth from 3.4% in January up to 3.5%

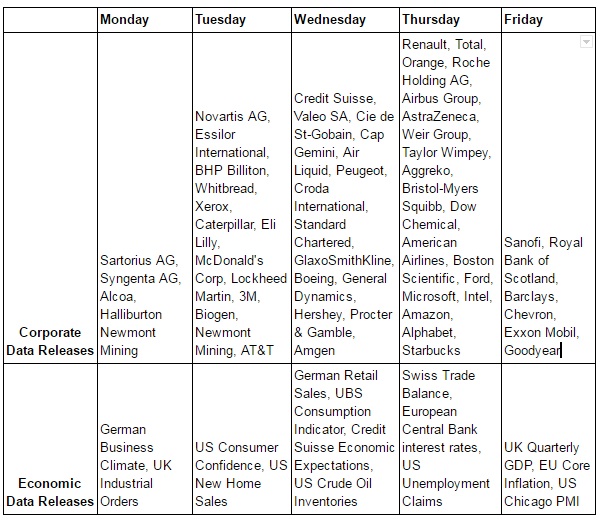

The Week Ahead

Economic Data

Last week might have technically been a short one with Bank holiday’s being enjoyed across Europe on Monday but it still managed to pack quite a punch. Tuesday saw more political risk being brought to the markets with Theresa May calling for a general election on the 8th June in the UK. I was under the impression Brexit meant the UK wanted to be different from the rest of mainland Europe, however, Theresa May has decided like her German, French, Dutch, Austrian and Italian counterparts a general election is required. Voting in France on Sunday has seen far right leader Marine Le Pen (21.53%) and centrist Emmanuel Macron (23.75%) through to the second round of voting on the 7th of May. Although the voting between these two was close analysts are expecting Mr Macron to find it much easier to pick up further votes now that the voters only have a choice of two.

On Thursday we will hear from the European Central Bank as they announce their latest interest rate decision. It is highly unlikely we will see any change being made to the current flat rate but the accompanying press Q&A session with ECB President Mario Draghi does tend to offer a little more insight into the ECB’s thinking.

Corporate Releases

A number of large Swiss companies will be releasing figures this week with Syngenta, Novartis, Credit Suisse and Roche Holding among them. By and large every sector will see a number of components reporting as the US reporting season is now in full swing.

The major pressures that companies will have to contend with are interest rate expectation, inflation, currency strength and finally, regulatory changes. This reporting season arguably more than any other before will see companies reflecting these pressures more directly.

Interest rate expectation is most likely to directly affect Financial businesses such as banks. The broad rule of thumb being that the higher the interest rate the better the profit margins. On the other hand, retailers and especially food retailers will find inflation is the aspect most likely to affect their profit margins and how much can be passed onto the consumer.

As previously highlighted, the market is waiting for further news on US corporation tax rates and how aggressively these may be reduced. Further to this, the UK post Brexit could also cut their rates in an effort to attract more business. All of these variables will come into play when markets analyse this reporting seasons data when gauging if results have been good enough or not.