Synopsis of the week

- Rather than focusing on Tax reforms or infrastructure spending the Tump administration are now embroiled in a conflict of issue surrounding the departure of FBI Director Comey.

- Soft economic data out of the UK points towards Brexit issues yet to materialize. Sterling eases lower as interest rate rises still look a long way off.

- European Central Bank President Mario Draghi talks up the EU’s health while still saying not the correct climate to reduce the current Quantitative easing scheme yet.

- Having rallied hard in the run up to the French election both the German DAX and French CAC have sold off over the week.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s Jonathan Ferro for an hour long show to discuss the Bank of England’s interest rate policy, European Central Bank president Mario Draghi’s latest interview and the strength of the Euro, the Trump Presidency and the looming G7 conference in Italy.

Click here to listen to the interview on Bloomberg

Fern Wealth Seminar

Following on from the success of our first seminar we are pleased to announce that we are inviting clients and prospects along to our offices for an informal evening of conversation and discussion on Tuesday 23rd May. Fern Wealth directors Steven Flintham and Alastair McCaig will be revealing “Why everyone should be investing in funds and how to get started” CLICK HERE for further details and to reserve your place.

Limited spaces left

The Week Ahead

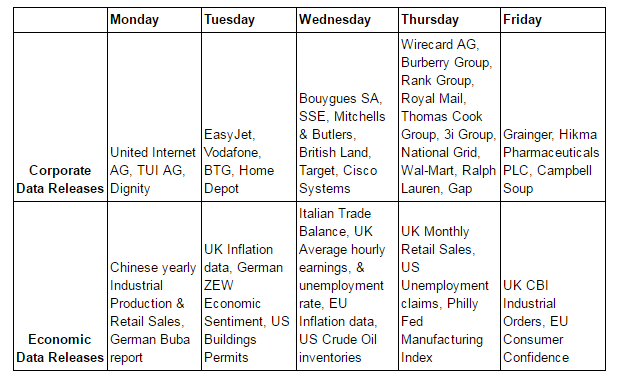

Economic Data

It would be hard to pinpoint economic data releases from last week that were truly awful but the sentiment at the end of the week was certainly underwhelming. The manufacturing, construction and industrial data out of the UK were all disappointing on Thursday and Fridays inflation and retail sales figures for the US were equally unimpressive.

The week gone has seen both the French CAC and the German DAX give back some of the ground that they had made over the previous two weeks. Certainly, in the case of France, it looks like a classic case of buy the rumour and sell the news. Following confirmation that Emmanuel Macron and not Marine Le Pen was the next French President French shares have sold off.

Over in the US Donald Trump has once again courted controversy with his dismissal of FBI director James Comey. Who the current or next director of the FBI does not bother the markets. What does bother the markets is the fact that once again a proportion of the Trump administrations time and effort will directed to something other than bringing about tax reforms or infrastructure spending. The lack of progress on these two issues is troubling investors which is why over the last couple of months we have seen a migration of investment money coming out of the north american markets and into the EU.

This weekend will also see the latest G7 conference taking place in Italy, although global protectionism is not on the agenda to be discussed it is a topic that will probably be broached by one of the members.

Corporate Releases

We are now coming to the end of this latest European reporting season. Of those companies that have reported 67% have beaten earnings expectations and 79% have beaten revenue expectations. If the remaining companies yet to report maintain this level of performance this could see European equities post their most impressive data in over a decade.