Synopsis of the week

- Having been almost 100% factored in the US Fed increased the base rate from 0.75% to 1% triggering a jump in equity markets.

- Europe looks on in disbelief as internal squabbles between Scotland’s First Minister Nicola Sturgeon and British Prime Minister Theresa May over shadow the anticipated triggering of Article 50.

- The Bank of England hold base rates steady at 0.25% while one member of the Monetary Policy Committee votes for change.

- Ahead of July’s G20 meeting for world leaders in Hamburg, finance ministers are due to meet in Germany over the weekend.

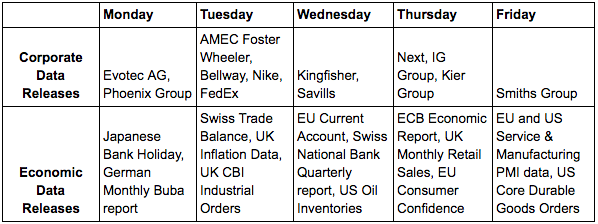

The Week Ahead

Economic Data

Almost everybody expected the US Federal Reserve to increase interest rates so Wednesday’s announcement of a 0.25% increase was already factored in by the FX markets as the US Dollar has gently strengthened throughout the week. Equity markets on the other hand, have been more positive in their response.

Donald Trump has now nominated his fifth Goldman Sachs alum as deputy treasury secretary, the specifics of who this is, is not the most relevant part. This gives a very strong signal to the markets that one of the most important aspects to this Trump administration is the business of business. This follows on from the confirmation that he would be budgeting a trillion dollars for infrastructure spending, adds even more weight to the assumption he will be looking to grow the US economy to an even stronger footing.

Even though the Dutch elections have now been completed, uncertainty will continue to hang over them for the next couple of months. It is most likely we will see a coalition party of four emerge and on average this process has taken 72 days to complete. The Dutch election news saw a jump in the French CAC and an improvement in French debt valuations. The reason for this being that Dutch far-right groups failed to gain as much strength as had been initially feared and this reduces the chances of a similar story happening in the looming French elections.

Corporate Releases

Major corporate data releases might be a little on the thin side for the week of the 20th but the last two weeks have seen a couple of very big FTSE stories appear. In the previous “week ahead” article I wrote about rumours surrounding BP, judging by the market’s reaction considerably more substance will be required to drive the price higher. This week it is the turn of Anglo American which saw its shares jump by almost 11% to 1325p following the news that Indian Billionaire and Chairman of Vedanta Resources Anil Agerwal was buying £2Bn of the company’s shares which would equate to a 12% holding.

Image by USA-Reiseblogger from Pixabay