Synopsis of the week

- Worries over the UK’s decision to leave the EU following the Brexit vote have not fully been reflected in the economic data releases.

- Inflation figures released around the world are still poor and well below the standard 2% target most central banks have set. However in the short term they are not getting worse and in the case of the UK surprisingly better than expected.

- Oil prices continue to climb higher with Brent Crude surpassing pre-Brext levels above $50 a barrel for the first time, and US light not too far behind. This even with a background of Saudi oil exports at record levels.

- Fourthly the release of the Fed’s minutes show that a consensus on raising the interest rate is still some way off as markets continue to price in a 50% chance of rates going up before the end of the year.

The week starting Monday 22nd will see traders watching out for Services and Manufacturing PMI data coming out from France, Germany the Eurozone & the US. Considering the collapse in consumer sentiment surveys, it will be interesting to see if this has translated into a noticeable change in economic momentum.

Oil traders have seen prices continue to climb over the last week. Wednesday’s US oil inventory figures coupled with recent highs over $50 could result in trader enthusiasm for the black gold dented.

With the wellbeing of the UK’s corporate environment in mind we should see some straight talking from the CBI as they are not likely to mince their words when talking through the consequences of May’s Brexit vote.

The week will be rounded off by the annual Jackson Hole Symposium where historically major shifts in US Fed thinking have been announced. Expectations of a surprise are low but who knows, maybe Yellen will pull a Greenspan/Bernanke on the markets.

Judging by the minutes from US Fed in their last meeting, the currency markets were left under impressed by the lack of action likely to materialise in the US . Institutional consensus points towards a GBP/USD rate close to $1.2600 by the end of the year. That’s on the proviso that the Fed raise rates before the years end. FX traders have spent most of this last year analysing which currencies have had to contend with the greatest amount of government stimulus packages eroding the sovereign currencies strength. GBP/EUR continues its descent and looks like it has lows of €1.1340 from February 2013 in its sights.

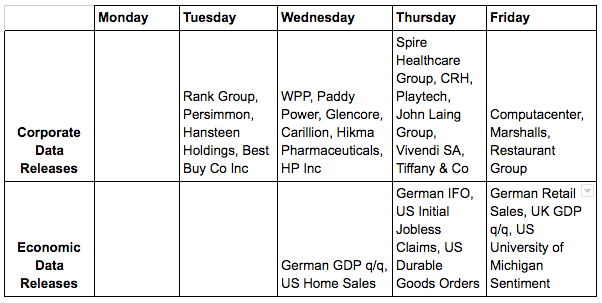

The week ahead

Turning to corporate data releases we still have a few big names coming out with figures even as the US reporting season has come to an end.

Wednesday will see the world’s largest advertising company WPP post its half yearly figures. As ever, the outlook on advertising spend is always a good barometer on corporate risk appetite.

Zug based Glencore one of the world’s largest commodity trading and mining producers are also due to post their half yearly figures on Wednesday. Over the last eleven months the company’s share price has climbed almost 100% but hovering just below £2 it still has a long way to go to get back to its 2011 IPO price of £5.30

Image by Erich Westendarp from Pixabay