Synopsis of the week

- As three members of the BoE’s Monetary Policy Committee vote for an interest rate rise, odds of an increase before the end of 2017 increase to 44% in line with expectations of another US rate rise.

- Oil prices continue to slide, with Brent Crude now down almost 17% in the last month taking the price back to November 2016 levels.

- A year on from the UK voting for Brexit there is arguably even less visibility of what the UK’s stance will be as EU negotiations have finally begun.

- While European equity markets have broadly moved laterally the Chinese CSI 300 has added almost 4% over the week.

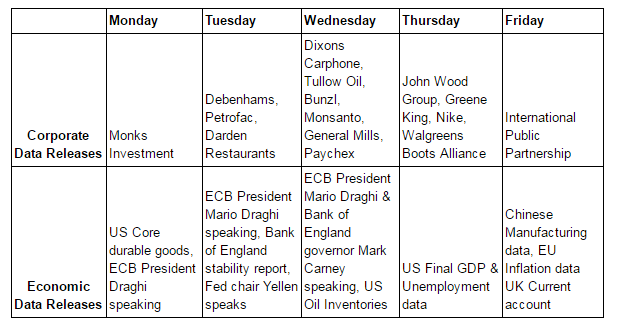

The Week Ahead

Economic Data

The first half of next week will be dominated by Central Bank speeches. The European Central Bank President Mario Draghi speaking on Monday, Tuesday and Wednesday at the European Central Bank forum in Portugal. Ahead of Brexit negotiations with the UK the EU has shown a united front and looks best placed to come out of these negotiations stronger. For their part, it is still difficult to be sure what the UK’s stance will be on a number of issues and with the Queen’s speech still, to be voted for in the House of Commons this week we could still see another UK election this year.

The Bank of England Governor Mark Carney will be speaking on Tuesday at the release of the latest Financial Stability report. Considering the week the BoE has had with the clear divide in opinion between Mark Carney and Andy Haldane this press conference could make for interesting viewing and is almost certainly going to have an effect on the strength of Sterling.

Wednesday will see the results of the second phase of US Bank stress tests. The markets are not expecting much in the way of bad news, in fact these results will probably give the sector a boost. The results of the stress test will confirm how much money US banks will be able to allocate towards both dividends and share buyback schemes.

With Oil prices continuing to be squeezed lower last week Wednesday’s Crude Oil inventories will potentially be another catalyst.

The attention on Thursday will revolve around the latest US GDP data, another indicator markets will use to gauge the likelihood of further rate rises in the US. Then on Friday morning we will get Chinese manufacturing data, UK Current account figures and EU inflation data.

Corporate Releases

This week will provide a little more interest for corporate data releases as we will hear from Nike, Debenhams, Tullow Oil and Greene King.