Synopsis of the week

- As expected the US raised rates, a move that had already been factored in by the currency markets.

- Thomas Jordan the Swiss National Bank chairman has once again confirmed the Swiss Franc is too strong and further currency market intervention and increasing the negative interest rate are both still options.

- The Bank of England Monetary Policy Committee vote to leave rates unchanged but three of the eight-vote to increase, boosting the strength of Sterling.

- Emmanuel Macron gains a majority in French parliament helping the Cac head higher on increased political stability.

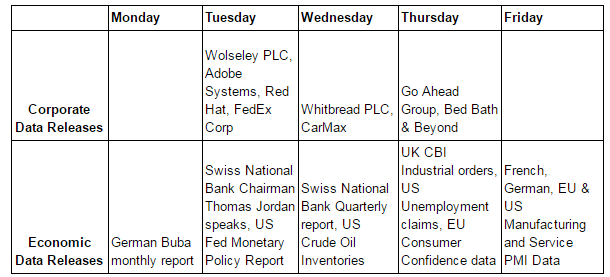

The Week Ahead

Economic Data

This will be a big week for the Swiss Franc as the Swiss National Bank (SNB) will be adding text to the interest rate decision that they made last week. Fern Wealth has stated on several occasions that it is our opinion the Swiss Franc will come under increasing pressure to devalue. Last week saw the SNB hold rates unchanged but the following interview with its Chairman, Thomas Jordan, gives a clear indication as to where the next moves are likely to be. On Tuesday 20th June Mr Jordan will be discussing the SNB’s views on Consumption, Investment, Employment and Inflation, all potential drivers for currency markets.

Swiss National Bank Chairman Thomas Jordan being interviewed on 15th June 2017 on Bloomberg

Obviously, we are closely monitoring the comments coming from the Swiss National Bank, but it is worth noting we are also seeing numerous other indicators that point towards a shift in the cycle of Swiss Franc strength. The Swiss stock exchange the SMI has rallied strongly in 2017 and at its peak was up by over 11%. The optimism for continued growth has however stagnated as the ratio of Puts to Calls on the index has hit its highest level since 1998. Put options are hedging tools used when investors are worried about the potential for markets selling off.

Swiss traders increase hedging against aggressive market sell offs

The UK’s monetary policy committee voted to leave interest rates unchanged, however, in the last meeting, only one member voted for an increase in the rate. At this latest meeting, three members have voted for an increase. Markets did feel that the UK would follow the US in raising rates, however, expectations were that this might not happen for some time. Last week’s vote has shown that an increase might happen faster than was expected and as a consequence, the strength of Sterling was given a boost on Thursday’s trading. Considering all of the complexities that face the UK in the coming weeks especially as Brexit negotiations start in earnest it will be interesting to see how long this sentiment can remain.

The French political scene looks to have become more stable following Emmanuel Macron’s presidential election victory. En Marche now has a majority in the French parliament giving President Macron and his party a solid base to run the country, a position that few political analysts thought would be possible only a short while ago.

Corporate Releases

We still have little in the way of corporate data to worry investors as the overall strength of equity markets continue to dominate investor sentiment.

Image by Kai Pilger from Pixabay