Synopsis of the week

- US equities have added to the momentum seen in 2017 and even the prospect of a long bank holiday weekend has not triggered profit-taking.

- The Euro has also enjoyed plenty of support this year and against the US Dollar has broken above last years highs. The Euro strength has subsequently seen a sell-off in the export-driven Dax.

- Angela Merkel looks to have finally made progress in forming a coalition but the whole process looks to have harmed her standing with the German public.

Press coverage

On Wednesday evening Alastair McCaig our Head of Investment Management joined host Jonathan Ferro and Bloomberg’s Head of FX & Rates strategy Richard Jones to discuss US Treasuries, UK manufacturing data and where to invest at the start of the year.

Click here to listen to the interview on Bloomberg.

Last week, I wrote about my outlook for the year ahead (which you can read here) and although I said I was optimistic that many of the factors that had helped the equity markets in 2017 were still in place, I did not really expect to see the US equity market charge higher this quickly. US equity markets, the S&P 500 and Dow Jones added almost 4% in less than two full weeks of trading. This is an impressive performance, but not a pace we expect to be maintained all year. Invariably, ahead of long bank holiday weekends when equity markets are shut, we see bullish markets easing off as profit taking takes place. This, however, did not materialise at the end of last week and we saw equity prices continue to move higher all the way into the close.

Whilst the US equity markets are performing exceptionally well, their European counterparts are struggling to keep up with them. Part of the reason for this has been the strength of the Euro currency. The German economy and to a lesser extent the French economy are both based on exports and the strength of the Euro has effectively increased the cost of EU goods to overseas buyers. The increased strength of the Euro is also being reflected in the EUR/CHF exchange rate as it sets fresh three year highs at 1.1800. We expect to see this template of the Swiss Franc weakening against the Euro maintained throughout the year.

This Friday is the deadline for US lawmakers to come to an agreement over the US debt ceiling to prevent a government shutdown. In December, the previous deadline was pushed forward to Friday 19th January and a further extension is unlikely. We expect to see a public outcry, bickering and squabbling, but ultimately an agreement will be found before the end of the week.

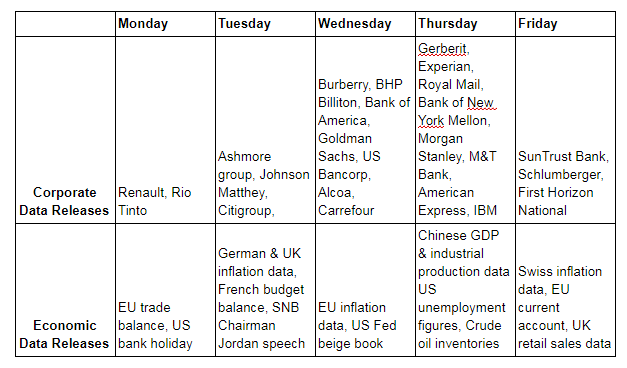

Corporate releases

This week will see the continuation of the US financial sector reporting data. Last week saw Wells Fargo write off another $3.25 billion as legacy costs from the financial crisis continue to hang over them. As legislation is being created around the new Trump tax reforms, we could see other “one-off” announcements from other US banks as they look to get their houses in order before the changes happen. The banking sector should be enjoying market confidence as rising interest rates will directly improve profit margins and the possibility the Trump administration will now focus on de-regulation would also add to sector sentiment.

Two of the mining sectors heavyweights in BHP Billiton and Rio Tinto are also announcing quarterly reports. We are seeing economic recoveries at various stages in Europe, Asia and the US helping make commodity prices and mining companies look a little more attractive.

Image by PublicDomainPictures from Pixabay