Synopsis of the week

- US equities remain strong this week driven higher by Apple’s announcement to increase investment in the US. This was encouraged by the recent changes in US Tax laws the Trump administration have managed to push through.

- Brent Crude Oil prices have hit three-year highs briefly breaking above US$70 a barrel up 147% from their January 2016 lows.

- The US government looks set for a shutdown as Friday’s last-second negotiations failed to reach an agreement on a budget extension.

Momentum continues to favour the Bulls as equity markets in the US, Europe and Asia all continued to tick higher. This latest corporate reporting season has seen broadly positive stories hitting the headlines. The only exception to that being the US financial sector who appears to be reorganising before the new Trump Tax reform changes take effect. The biggest cloud on the horizon has been the possibility of a US government shutdown as the Republicans and Democrats continue to squabble over the Federal budget. The last time this happened was in 2013 when non-essential government agencies were forced to shut down for 16 days at an estimated cost of US$3 billion to the US economy.

This last week has seen a number of benchmarks reached in markets. The US Dollar has hit a three year low while the Euro has hit a three year high. The Nikkei has hit a twenty-six year high while the S&P 500 and Dow Jones continue to charge high setting fresh highs as they go. It does feel like equity investors around the world have all started the year in a very positive mood.

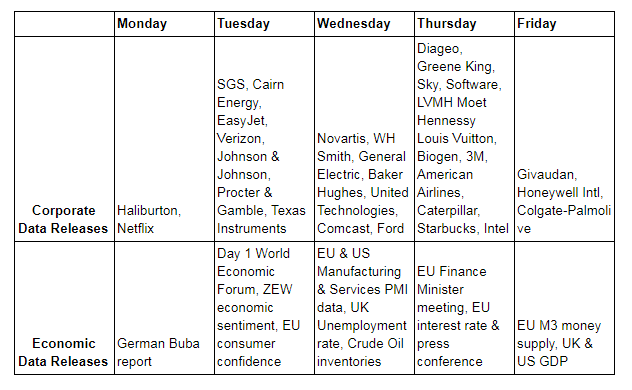

Tuesday will see the start of the latest World Economic Forum here in Davos, Switzerland. This year, US President Donald Trump will be in attendance, having missed last years discussions. Once again, this will give many of the world’s senior business and corporate leaders an opportunity to discuss major developing events. Although no firm decisions will be made, it is likely we will see a number of themes highlighted during the Forum develop through the year.

This week will also see some meaningful economic data being released as US & EU manufacturing and service PMI data are due out on Wednesday. Both economic regions have seen steadily improving, if not spectacular, results over the last twelve months.

Corporate releases

The “FAANG”1 stocks have been some of the largest contributors over the last twelve months as the US markets have charged higher. On Monday, we will get to see quarterly figures from the first of the group as Netflix is set to update the markets. Although the business models of these companies are quite different, they have all been viewed as the new wave of businesses and a poor set of results for Netflix might just see the high levels of optimism for the rest reigned in a little.

1Facebook, Apple, Amazon, Netflix & Google

Photo by Morning Brew on Unsplash