Synopsis of the week

- The last remaining moderate member of President Trump’s cabinet Gary Cohn has resigned over the US implementation of Steel & Aluminium tariffs.

- The ECB has removed the option of increasing or extending the current Quantitative Easing scheme and have raised growth expectations for 2018.

- Fridays impressive US Non-farm payroll figures certainly helped the markets end the week on a positive note as equity indices continue to edge higher from February lows.

Press coverage

On Wednesday 7th March Fern Wealth Head of Investment Management Alastair McCaig spoke with Bloomberg anchor Jonathan Ferro and FX and Rates Strategist Richard Jones. On this week’s show, they discussed the departure of US President Donald Trump’s chief economic advisor Gary Cohn, US Treasury markets and the possibility of US Chinese trade wars.

Click here to Listen to the interview on Bloomberg.

The departure of Gary Cohn, the former Presidential economic advisor, was something that many people had seen coming. He had been the last member of the inner circle of Trump advisors who had been battling to avoid a global trade war and following the announcement of Steel & Aluminium tariffs decided to leave. Equity markets sold off after this, not because these metals tariffs would cause so much damage but because the obvious conclusion was, this was only the start of the US President’s list of trade wars he would want to fight.

Last week, the European Central Bank became the latest global central bank to eulogise the strength of the economic fundamentals in their region. Mario Draghi, the ECB President, removed the paragraph in his prepared speech about the bank being willing to extend the timeline and increase the monthly purchases of Quantitative Easing if required. This marks the beginning of the end for the current QE scheme and reflects a growing belief that the EU has turned a corner and is well on the way to recovery.

The action of the ECB last week and of the US Fed and the Bank of England in the weeks before, show that regardless of the increase in market volatility, central banks have not felt the need to intervene in the markets. Although the ECB is removing what has been a supportive measure for equities, the markets have taken this news well. If the ECB believes that the economics can handle the withdrawal of QE then this is a ringing endorsement of economic strength.

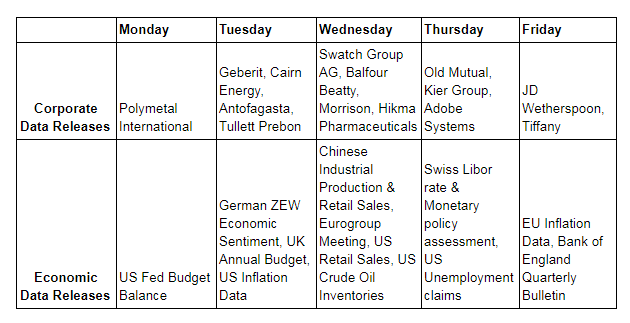

The US Federal budget balance and the Bank of England quarterly report book-end this week with the Swiss National Bank monetary policy squeezed into the middle of the week. Economic data releases have proven to be very resilient over the last year and continue to offer central banks the ability to work towards rate normalization and stimulus reduction. Our belief remains that 2018 will be a positive one for markets, even though we have had to absorb a technical market correction in the first quarter of the year and the markets, somewhat erratic, climb back up again.

Corporate releases

Another quiet week for corporate releases, although CHF 21 Billion Swiss watchmaker Swatch group are reporting on Wednesday this week and due to their size do have the ability to move the Swiss market.

Photo by bruno neurath-wilson on Unsplash