Synopsis of the week

- Having missed coming to Davos last year, US President Donald Trump’s presence has caused quite a stir as his views on the US Dollar strength and ongoing trade negotiations have been closely scrutinized.

- The US dollar continues to be weak, down 3.7% so far this year and down 1.53% this week alone.

- The majority of financial institutions were positive about equity markets for the next twelve to twenty-four months.

Press coverage

On Wednesday 24th January, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro, FX & Rates strategist Richard Jones and Global macro specialist Vincent Cignarella to discuss Davos, the US dollar and how the year is shaping up.

Click here to listen to the interview on Bloomberg.

Last week was always going to be prone to market moves triggered by comments coming from delegates in Davos rather than economic data releases. The most obvious reaction that we saw, followed US Treasury Secretary Steven Mnuchin’s statement “Obviously a weaker dollar is good for us”. Two days later US President Donald Trump said: “The dollar is going to get stronger and stronger, and ultimately I want to see a strong dollar”. These two opposing statements left currency markets baffled and saw the US Dollar aggressively drop in value.

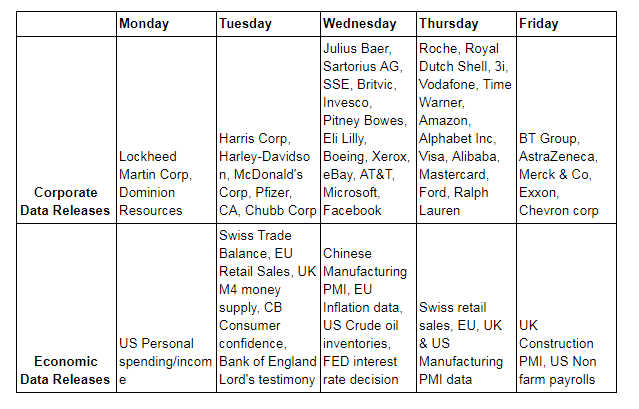

The week ahead should once again see markets being moved by a combination of economic data releases and corporate updates. Throughout the week, we will get updates on manufacturing figures for China, EU, UK and the US and these figures are always a good indicator of consumption. One speech that will be worth listening too will be President Trump’s State of the Union address on Tuesday. This will give him an opportunity to highlight the progress made by the administration and outline what he has planned for the future. The two headline announcements will be Wednesdays FED interest rate decision and Fridays US Non-Farm payroll data. The markets are not expecting the FED to raise rates this time round but will be paying close attention to the wording of the announcement to confirm that they are still on track to raise the rate three times during 2018. This will be FED chair Janet Yellen’s last meeting before stepping down. If this confidence were to be shaken that would most likely trigger more pressure on the battered US Dollar. She is not renowned for being self-congratulatory so this could pass without too much of a fan fair.

Corporate releases

Although the Netflix business model is quite different from the other members of “FAANG” another stellar quarter, does bode well for this week’s members releasing data. We will hear from Alphabet (google), Amazon and Facebook between them account for over US$2,025 billion of market capitalization. The other area that will be extensively covered this week will be major oil producers with Royal Dutch Shell, Exxon & Chevron all releasing quarterly updates.

Photo by Evangeline Shaw on Unsplash