Synopsis of the week

- European and US equity markets sold off last week as Friday’s bank holiday in America encouraged traders to take short term profits before the long weekend.

- Theresa May has had to make a second cabinet change in the last two weeks, begging the question for many as to how long she can remain in power and lead the Conservative party.

- US President Trump has finished his tour of Asia where his discussions with Japanese, South Korean & Chinese leaders revolved around trade deficits and security.

Press Coverage

On Wednesday evening Alastair McCaig our Head of Investment Management joined Bloomberg hosts Jonathan Ferro to discuss the problems facing British Prime Minister Theresa May, Snapchat and President Trumps tour of Asia.

Click here to listen to the interview on Bloomberg

After several weeks where equity markets have had little trouble in climbing higher, we have finally had a sell off. The DAX was down almost 3% by the end of the week with the German banking sector driving this move, in particular, the two large contributors, Deutsche Bank and Commerzbank. The US markets were also softer but not by enough to call it a correction. The “Veterans Day” Bank holiday last Friday gave some of the short term traders reason to take some profits off the table on Thursday. The long weekend in the US also added a lack of enthusiasm for global markets during Friday’s trading session.

The ebbs and flows of equity markets are part of the investing experience and periodically having corrections helps reign in over enthusiasm. Over the last five years, we have seen institutional investors take every opportunity to add to their exposure on any pull back. This week saw Credit Suisse raise their outlook on equities from Neutral to Positive suggesting that they are inclined to add to their equity exposure if opportunities like this arise.

We will be paying even more attention to bond markets next week as this will see the largest tranche of Eurozone debt being issued since the European Central Bank announced its plans to half its current QE scheme. Although the ECB will not be reducing its monthly debt purchases from €60Bn to €30Bn until January, this will still be an interesting gauge on market appetite. It is also worth noting that Spain will be issuing 50 year debt despite unrest in the Catalan region escalating.

Saturday was Chinese singles day, an Asian alternative to Valentine’s day where instead of spending money on a loved one you spend it on yourself. This has become incredibly popular in China where yesterday saw US$25 Billion in spending in a single day. America’s own crazy day of shopping “Black Friday” is only a couple of weeks away on the 24th November and it will be interesting to compare how many Billions US consumers spend on that day.

Since Theresa May triggered Article 50 with the EU over seven months ago, very little progress has been made and having overseen a disastrous general election, her credibility has been under constant scrutiny. Things might finally be coming to a head after she lost two members of her cabinet in the last two weeks following two separate scandals. These events will see the Conservative party questioning her ability to stay on as Prime Minister and party leader.

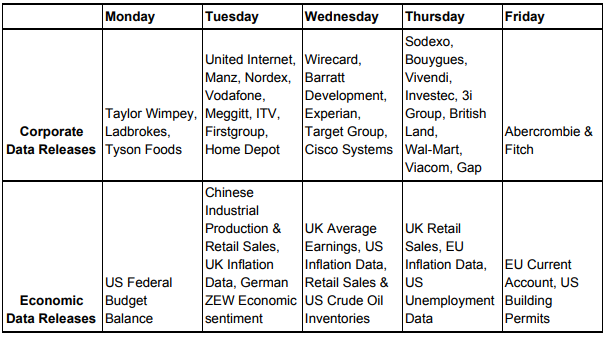

Monday’s US Federal budget balance should be a punchy way to start the week with only an exceptionally bad set of figures capable of altering current expectations of a December rate rise in the US. Throughout the week, we will also see retail sales figures released from China, the US and the UK. Consumer spending has been one of the most important drivers helping economic regions recover since the financial crash. This will also tie in with corporate data releases from Home Depot, Target and Wal-Mart, some of the largest US retailers.