SYNOPSIS OF THE WEEK

- The Swiss National Bank keep rates unchanged and confirm the Franc is still overvalued.

- Opinion polls point towards another Angela Merkel lead coalition in Germany keeping the DAX treading water.

- The US Dollar sells off as optimism about another interest rate increases are negated by worries over the looming debt ceiling debate.

THE WEEK AHEAD

At its September quarterly policy meeting on Thursday last week, the Swiss National Bank (SNB) made no changes to the interest rates which will continue to remain at -0.75%. The SNB’s mandate is to achieve price stability while also supporting economic activity, and they are willing to intervene in the Swiss currency markets where necessary to achieve this end. The aim of these negative rates is to make Swiss investments less attractive and ease the upward pressure on the currency. Because the Swiss Franc has weakened against the Euro and strengthened against the dollar, the bank changed its stance on the Franc from “Significantly overvalued” to a softer “highly valued”. This did not trigger too much of a move as the EUR/CHF continues to test resistance at 1.1500.

The German Dax started the week off strongly, but following moves seen on Monday and Tuesday, plateaued as the week progressed. Current polls for the next German election on Sunday strongly suggest that Merkel will hold onto power. This is good news for the markets where momentum has slowed as traders have been waiting to see how the election would progress. Though the German equity market within the Eurozone is facing a little uncertainty, over the next 10 days the markets will stabilize as anxiety within the political markets dissipates.

In the UK, the consumer price index (CPI) inflation data releases came in much stronger than expected at 2.9% up from 0.6% in September last year. The Bank of England (BOE) governor, Mark Carney, stated that this strong inflation data will strengthen the need to increase interest rates. To illustrate the severity of this move, the last time they were raised in England was June 2010. This has seen the GBP climb against the USD by almost 3% over the week.

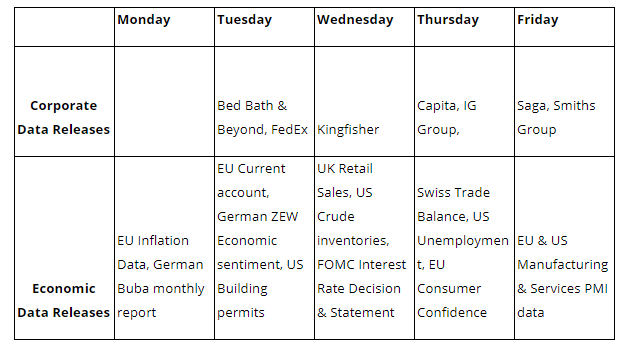

On Wednesday, the September Federal Open Market Committee (FOMC) will announce what changes (if any) to the current US interest rate will be made, and will also be looking to start reducing the US’s balance sheet. It does not look like the US CPI inflation data rising to 0.4%, the largest in seven months, is forcing the FOMC’s hand into action, and they will continue to delay rising rates until December.

CORPORATE RELEASES