Synopsis of the week

- Good corporate earnings announcements and solid expectations help equity markets hold on for a second positive week in a row.

- Fridays intraday trading saw EUR/CHF trade above 1.2000 for the first time since the Swiss National Bank were forced to pull its peg on Thursday 15th January 2015.

- Falling inflation figures from the US, EU & UK have seen expectations for future interest rate rises ease.

Press coverage

On Thursday 19th April, Alastair McCaig, our Head of Investment Management, joined Ana Maria Montero on CNN Money Switzerland, where he chatted about Swiss equities, the current market conditions, expectations for interest rate increases from central banks and the Swiss Franc.

Click here to watch the interview on CNN Money Switzerland

On Wednesday 18th April, our Head of Investment Management, Alastair McCaig, joined Bloomberg anchor Jonathan Ferro and Ken Veksler, Director at Accumen Management. On this week’s show, they discussed geopolitics, UK inflation, interest rate expectations, bond markets & the Swiss Franc.

Click here to Listen to the interview on Bloomberg.

For the first time in over three years, the EUR/CHF rate has traded back above the 1.2000 level. For the past two years, we have continuously stated that we felt the Swiss Franc was overvalued and that the EUR/CHF rate would climb higher. In this time, we have seen the Euro appreciate against the Swiss Franc by just over 10%. Although we believe that the EUR/CHF will continue to set multi year highs, it is worth remembering that this was the level that the Swiss National Bank defended for so long and as such is a very big psychological level and could see momentum struggle. Any meaningful dip below this EUR/CHF 1.2000 level would encourage us to look at further client conversion of Swiss Franc based wealth into Euros. It is worth remembering that this level was the Swiss National Banks last line of defense rather than where they perceived fair value for the Franc against the Euro. The SNB Chairman Thomas Jordan will be giving a speech on Friday morning and we would expect him to maintain the Banks commentary that the Franc is still overvalued.

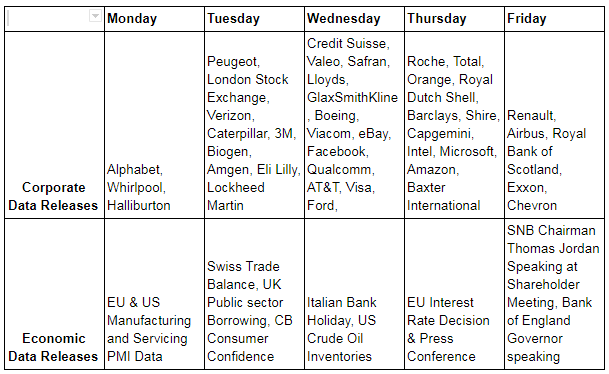

Although this week will be dominated by Corporate quarterly newsflow, we will also have some important soft and hard economic data releases too. The hard data revolving around the US & EU is out first on Monday when we will see releases on both the Manufacturing and Service sectors, whilst the soft data in the form of the latest CB consumer confidence data will be posted on Tuesday.

Corporate data

We are now well into the second quarterly reporting period of the year and those companies that have reported so far have on average beaten market expectations. It is still early but we are on track to see US earnings increase by 18% this year. As is always the case, the devil is in the detail and it is encouraging to see that sales growth has been strong so far and it is this increase in revenue, rather than further cost cutting, that has help companies profitability.

This week will see Amgen, Biogen and Shire all updating the markets with quarterly figures. Although the Biotechnology and Pharmaceutical sectors have struggled with stock market valuations, we have felt more Mergers & Acquisitions would materialize over the next year or so. Last week saw the announcement that Takeda Pharmaceuticals were looking to acquire Shire Plc. Shire’s share price has now climbed by over 30% in the last three weeks as expectations of a takeover increased. One swallow doesn’t make a summer but this does strengthen our belief that these unloved sectors will benefit from more M&A activity and still offer investors value.

Photo by Micheile Henderson on Unsplash