Synopsis of the week

- On Thursday 26 October, Euro bulls drove the EUR/CHF to fresh two year highs above 1.1700 ahead of President Draghi’s much anticipated QE speech.

- The Bank of England looks set to join the US Fed in moving towards rate normalisation by raising interest rates for the first time in over a decade. Futures markets are suggesting an 80% chance of a rate rise on Thursday 2 November.

- The end of the week saw Catalan lawmakers vote to set up an independent state from Spain. Ironically, this action is bound to see administration of the Catalan region being transferred out of Barcelona over to Madrid.

Fern Wealth Seminar

On Tuesday 7th November at 6.30 pm Fern Wealth will be holding another of their successful seminars, the topic of which will be “Why you should be investing in funds and how to get started”. Light refreshments will be available and we anticipate an extremely interesting and socially pleasurable evening with the attendance of existing clients and interested parties.

Click here for further information and an ability to register

Press Coverage

On the evening of Wednesday 25 October Alastair McCaig, Head of Investment Management, joined Bloomberg hosts Jonathan Ferro and Richard Jones to discuss the way ahead for the Bank of England, President Trump’s preference for the next Fed Chair and the latest moves in the bond markets.

Click here to listen to the interview on Bloomberg

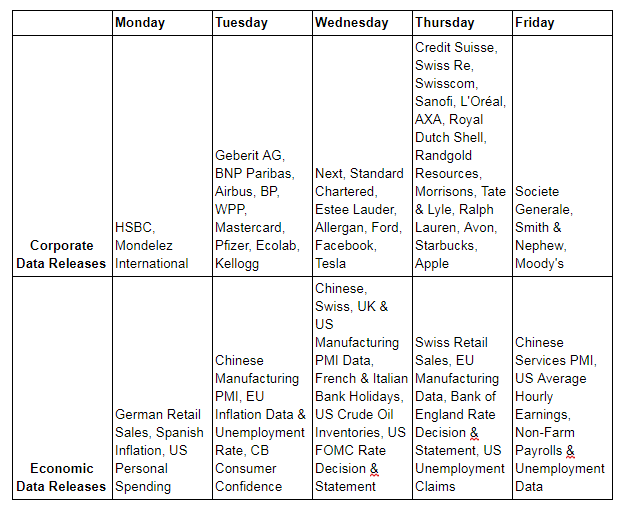

As has been the case for the major part of the year, politicians continue to be the biggest catalysts for change in the markets and even in the heart of this latest reporting season, corporate data releases continue to take second place. Last weeks comments from President Trump asking for a show of hands on who should be the next Fed Chair was the latest novel approach to decision making from the President. The importance of the decision has not been lost on traders as it is still proving difficult to understand what the President might do next. Whoever is at the helm of the Fed will play a significant role in deciding how quickly interest rates are raised in the US so this will continue to dictate the strength of the US Dollar.

The continually improving economic data emerging from the EU, albeit from a very low starting point, has given the European Central Bank the opportunity to announce an aggressive reduction to its current Quantitative Easing scheme. Having already reduced the monthly purchase of bonds from €80 billion down to €60 billion they have now announced a further reduction starting from the beginning of January 2018 when they will halve their budget down to €30 billion a month. Although this will offer less of a financial boost to the markets, investors have taken this news well as it reflects how confident European Central bankers are in the economic recovery that is currently going on.

On Thursday 2 November, the Bank of England will be announcing their latest interest rate decision. If, as Futures markets are estimating an 80% chance of this, it will be the first interest rate rise by the Bank of England in over a decade. Although most market watchers are convinced of this,very few envisage more increases in the near future. The continuing indecision of Brexit negotiations offer little ability for Mark Carney and his team to see too far into the future. This news has already been factored in by the currency markets as Sterling has enjoyed a strong run. How able the British pound is to hold onto these moves will probably be decided by how many of the UK’s nine strong monetary policy committee voted this change through.

Last week saw Swiss based engineering group ABB Ltd post their third quarter’s figures. This data was their strongest in almost three years and underlined why the markets have driven the share price up by over 17% in the last few months. Market confidence in the company’s ability to capture a large slice of the $500 billion on offer for the new mega-city project in Saudi Arabia has seen shares hit highs last seen in 2008. The second half of this week will see heavy hitting Swiss firms Credit Suisse, Swiss Re & Swisscom all posting market updates too.

At the risk of repeating myself, I feel it is important to once again point out the moves seen in EUR/CHF as it rose above 1.1700 during the week. These latest rises probably have more to do with Euro strength rather any further weakness in the Swiss Franc but take us a step closer to 1.2000 where the Swiss National Bank previously had the currency pegged. Although EUR/CHF is up by 5.9% since our seminar back in May we still believe that Swiss Franc earning clients still have an opportunity to take advantage of the relative strength of the currency.