Synopsis of the week

- Last week, markets reacted badly to both Amazon & Alphabet figures denting the Tech sector’s track record. With Apple up this week, we hope the sector will have something to be more optimistic about.

- UK Prime Minister Theresa May’s reign looks increasingly fragile and with the UK Budget on Monday and the Bank of England’s interest rate decision on Thursday, we don’t expect too much for her to cheer about any time soon.

- US corporate growth still looks set to grow by over 20% regardless of the intra-week volatility we are seeing.

Press coverage

On Wednesday evening, our Director of Investment Management Alastair McCaig joined Bloomberg anchors Jonathan Ferro and Guy Johnson for the weekly Cable show. This week, they discussed Deutsche Banks quarterly figures and the upcoming European Central Bank meeting and the current rate of inflation.

Click here to listen to the interview on Bloomberg

On Thursday evening, Alastair McCaig, our Head of Investment Management joined Hannah Wise on CNN Money Switzerland to review third quarter figures from ABB and UBS and how the Swiss markets were performing. During the show, they also looked ahead to Alphabet and Amazon who were both reporting later in the evening.

Click here to watch the interview on CNN Money Switzerland

The last couple of months have seen an upturn in market volatility as investors have struggled to balance their sense of fear and greed. In recent years before 2018, we had seen markets rise with very low volatility but this year’s conditions are more closely aligned with what we have seen in historical terms. The US still has record low unemployment levels and average hourly earnings continue to grow, with 70% of the US economy made up of retail consumer spending. This does underpin the strength of the US economy. As regular readers of my weekly note will know we have been discussing trade wars, Brexit, rising Treasury yields and Italian budget problems for some time and it is taking investors some time to adjust to these issues. This volatility has brought up the longstanding debate of active over passive investing. Some of this market volatility is probably down to passive investors either being stopped out or closing out positions, while active investors will be looking at where best to take advantage of these market dips.

This third quarter reporting season has so far been good and we are still expecting to see an average of more than 20% growth in earnings. If this does happen, we will have seen three quarters in a row with this pace of earnings growth. Although we have seen most companies confirming good historical data from how they have performed in the previous quarter they have also been announcing a more cautionary note for their outlook to Q4. This more cautionary tone from US companies has come about because of the tit-for-tat trade war between the US & China.

On Thursday last week, we heard from both Amazon and Alphabet as they released their third-quarter figures, both following the same template of good historical data and more cautionary expectations for the next quarter. These two companies account for more than 50% of the FAANG stocks and have subsequently played a major role in driving equity markets higher. Markets reacted poorly to the forward guidance announced from Amazon even though they announced a record quarterly profit which took its profits for the year up to $2.9 Billion. Amazon like many companies have come out with a cautionary note with its forward guidance. However putting this into context, they announced expectations for fourth-quarter revenue up to $72.5 Billion while the markets were expecting $73.8 Billion making the sell-off look, more than a little overdone.

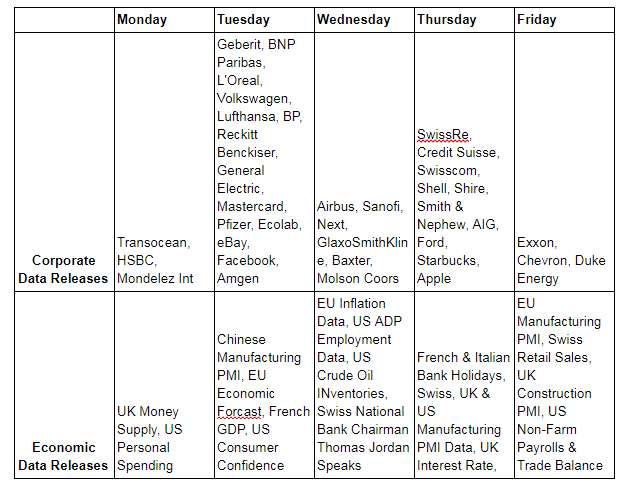

The week ahead will offer us a plethora of economic data releases revolving around the Eurozone. Last week speeches from ECB President Mario Draghi would suggest he is confident these releases will support the region. The tail end of the week will also see investors’ focus shift back to the US who are due to report monthly employment data. After September soft figures, we are expecting an upward bounce and average hourly earnings are called to grow by 3% the highest levels since 2008.

Image by Gerd Altmann from Pixabay