Synopsis of the week

- Last Friday’s bounce in equity markets has only lessened the losses on the week as equity markets have again struggled for confidence.

- As oil prices hit new multi-year highs last week, US President Trump called on Saudi Arabia to increase its output by 2 million barrels a day in order to counter the effects of Iranian and Venezuelan production falls.

- This weekend also saw the US President state the EU was just “as bad” as China when discussing his efforts to tackle trade issues.

Press coverage

On Wednesday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Bloomberg’s Head of FX and Rates strategy Richard Jones to discuss the latest developments in the Trump administration’s Trade Wars, the US Dollar and the consequences of the reigning World Cup Champions Germany being knocked out of Russia 2018 in the group stages.

Click here to listen to the interview on Bloomberg

Yet again, investor confidence was tested last week by geopolitical issues. When specific problems repeat themselves, markets will become more accustomed to them and over time will become less reactionary to these same problems. Equity markets have remained nervous for most of the last five months and have struggled to adapt to what is the new normal for 2018. Part of the reason for this is undoubtedly the fact that most of these worries are being triggered by the US President and his administration team, arguably the most important figureheads in the world. The length of the current bull market may also be playing a part. Markets are cyclical and we have enjoyed eight years of recovery and bull market conditions, more often than not this length of market momentum will see conditions reverse. That being said, there is no rule that says markets must have a bear market after eight or nine years of bull market conditions. The end of bull market conditions normally coincide with a deterioration in the economic data releases but this, however, is not the case at the moment. Both corporate and economic data releases remain strong and central banks are only part of the way through reducing stimulus and increasing interest rates.

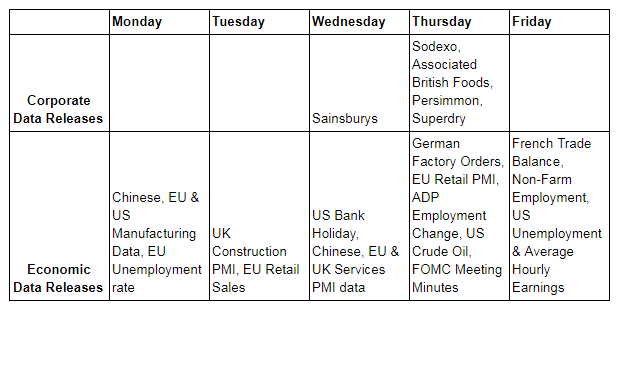

This could be quite a disjointed week with numerous important economic data releases from all the major economic regions in both halves of the week. The week itself will be broken up in the middle with the US enjoying its fourth of July bank holiday on Wednesday. Over the week, we will see Servicing, Manufacturing and Retail data all being posted, however, the data even more likely to move markets will all come out afterwards. On Thursday evening, we will get the latest minutes from the US FOMC. These minutes should give us a better take on the number and speed of US interest rate rises during 2018. Any shift in the expectations on rates will trigger a move on the US Dollar. Considering how fragile the emerging market economies already are from previous rate rises, they will be the most vulnerable areas to any further change. Friday could be the most important day of the week with US Non-Farm payroll figures and the average hourly earnings data being released. US employment levels are already high and wages have been increasing too, should this template remain, it would be another strong signal of the US economies health. Friday 6th will also see the first tranche of US sanctions on Chinese goods coming into action and the Chinese stock market is already suffering more than just a correction. Following last weekend’s comments from President Trump, we will also be watching out for further statements about sanctions being aimed at the EU.

Image by Gerd Altmann from Pixabay